The New Silk Road Runs on Gas: The LNG Partnership

In an era defined by shifting geopolitical currents and an accelerating global energy transition, the strategic partnership between China and the United Arab Emirates (UAE) is carving out a new paradigm for international cooperation. This collaboration, particularly in the realm of Liquefied Natural Gas (LNG), is rapidly becoming a cornerstone of what might be termed the ‘New Silk Road Runs on Gas.’ Far from being a mere transactional relationship, it represents a profound alignment of national interests, driven by China’s insatiable demand for secure, cleaner energy and the UAE’s ambitious vision to diversify its energy exports and solidify its position as a global energy hub. This article will delve into the industrial perspective, trace the historical threads that bind these two nations, and project the future trajectory of their burgeoning energy alliance, demonstrating how their LNG partnership is not just a commercial success but a testament to enduring diplomatic and economic synergy.

II. Historical Foundations: From Ancient Trade Routes to Modern Diplomacy

The narrative of cooperation between China and the Arabian Peninsula is not a recent phenomenon; it is deeply rooted in millennia of exchange. The ancient Silk Road, a legendary network of trade routes, served as a vital conduit not only for goods but also for the invaluable exchange of ideas, cultures, and innovations between the East and West. This historical precedent laid the groundwork for a relationship built on mutual respect and shared prosperity, a legacy that continues to inform modern diplomatic and economic engagements. The historical ties between these regions, characterized by peaceful trade and cultural diffusion, fostered a deep understanding and mutual appreciation that transcends mere commercial interests [1]. This long-standing tradition of connectivity provides a rich backdrop for the contemporary energy partnership, demonstrating a continuity of strategic interaction over centuries.

Fast forward to the contemporary era, the formal establishment of diplomatic ties between the UAE and the People’s Republic of China in 1984 marked a pivotal moment, ushering in an era of structured cooperation. This diplomatic recognition was quickly followed by a series of high-level exchanges that solidified the nascent relationship. The relationship gained significant momentum with the landmark visit of Sheikh Zayed bin Sultan Al Nahyan, the UAE’s Founding Father and first President, to China in 1990. This historic visit was not merely a ceremonial gesture; it was a strategic diplomatic overture, making Sheikh Zayed the first head of state from a Gulf Cooperation Council (GCC) nation to hold an official visit to China. Received by former Chinese President Yang Shangkun, his visit set a powerful precedent for multifaceted engagement, extending beyond traditional oil trade to encompass broader economic, cultural, and political exchanges [2]. This early engagement laid the groundwork for a comprehensive strategic partnership.

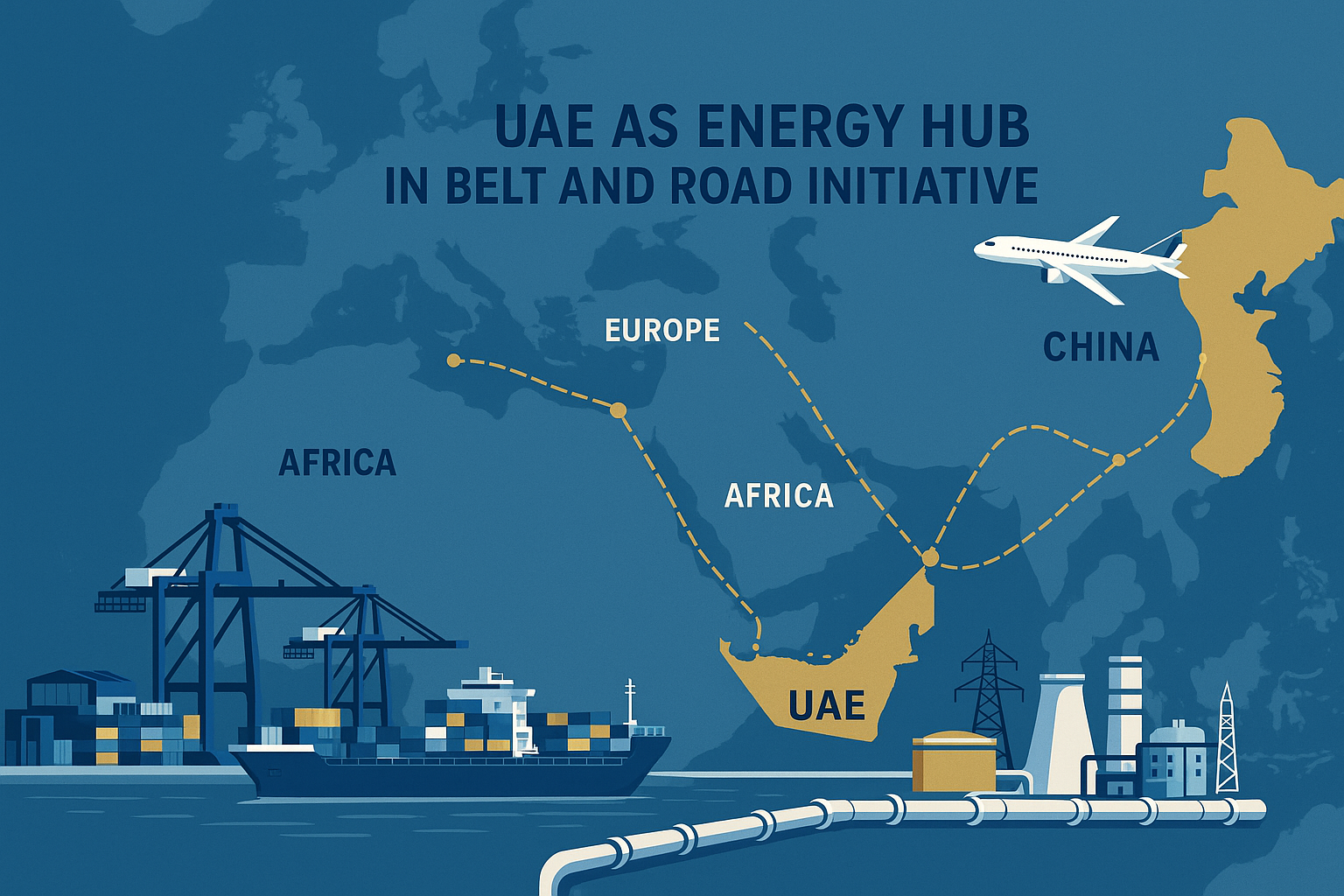

Over the past four decades, this vibrant partnership has flourished, underpinned by the signing of over 130 bilateral agreements and Memoranda of Understanding (MoUs). These instruments have facilitated extensive collaboration across diverse sectors, including tourism, industry, technology, and media, fostering a robust framework for cooperation. A significant contemporary driver of this deepening relationship is China’s ambitious Belt and Road Initiative (BRI). The UAE has emerged as an enthusiastic and active participant in this modern-day Silk Road, leveraging its strategic geographical position and robust infrastructure to strengthen economic partnerships and foster new linkages across continents. The BRI, in essence, has provided a structured framework for enhancing connectivity and collaboration, echoing the spirit of its ancient predecessor and expanding the scope of bilateral engagement into new domains of infrastructure, trade, and investment [2].

The economic fruits of these flourishing ties are evident in the robust trade figures and reciprocal investment flows. In 2023, non-oil trade between the two nations witnessed a substantial 12% increase, reaching an impressive US$80.6 billion. This growth highlights the diversification of their economic relationship beyond hydrocarbons. Investment flows have also been significant and reciprocal: the UAE invested US$11.4 billion in China between 2003 and 2022, targeting key sectors such as real estate, financial services, green energy, and transportation, reflecting a forward-looking investment strategy. Concurrently, Chinese investment into the UAE during the same period stood at US$6.9 billion, underscoring the balanced and mutually beneficial nature of their economic relations and the UAE’s attractiveness as a regional hub for Chinese enterprises [2]. This historical trajectory, from ancient trade to modern strategic alliances and significant economic interdependence, forms the bedrock upon which the contemporary energy partnership is built, demonstrating a deep-seated and evolving relationship.

III. The Industrial Imperative: China’s Thirst for Gas, UAE’s Supply Ambition

China’s economic ascent over the past few decades has been nothing short of remarkable, transforming it into a global economic powerhouse. However, this unprecedented growth has brought with it an escalating and complex demand for energy. As the world’s largest importer of Liquefied Natural Gas (LNG), China faces a dual imperative that shapes its energy policy: first, securing a stable and diversified energy supply to fuel its vast industrial engine and sustain its economic momentum; and second, transitioning towards cleaner energy sources to combat severe environmental challenges, particularly air pollution, and meet its climate commitments. The nation’s strategic pivot away from coal, historically its dominant energy source, and its concerted efforts to reduce reliance on politically sensitive energy suppliers have made natural gas, and specifically LNG, a critical and indispensable component of its long-term energy security strategy [3]. This insatiable and evolving demand creates a powerful pull factor for global LNG producers, driving strategic partnerships with reliable suppliers.

On the other side of this burgeoning partnership lies the United Arab Emirates, a nation that has long been a linchpin of global energy markets due to its vast hydrocarbon reserves. However, the UAE is not content to remain solely a crude oil exporter; it is strategically positioning itself as a global energy powerhouse with a diversified portfolio, actively expanding its role in the natural gas sector. The Abu Dhabi National Oil Company (ADNOC), the UAE’s state-owned energy giant, has embarked on an ambitious expansion strategy in LNG production and export. This strategy is not merely about increasing output; it is a calculated and forward-looking move to diversify the UAE’s economy, enhance its influence in the global energy market, and specifically target high-growth Asian markets, with China at the forefront of its strategic considerations [4]. ADNOC’s significant investments in developing its LNG capabilities, including the massive Ruwais project, underscore a clear and determined vision to become a leading global supplier of natural gas, meeting the world’s growing demand for cleaner fuels.

The economic rationale underpinning this partnership is not only compelling but also deeply rooted in mutual benefit and strategic alignment. For China, securing long-term LNG supply agreements with the UAE offers unparalleled stability and predictability, which are crucial elements for national energy planning, industrial operations, and sustained economic growth. These agreements are vital in mitigating the inherent volatility of global spot markets and significantly reducing geopolitical risks associated with other, potentially less stable, supply routes. For the UAE, China represents a vast, reliable, and long-term demand market, providing the necessary certainty and confidence for substantial investments in LNG infrastructure, from upstream gas development to liquefaction plants and export terminals. This symbiotic relationship ensures a steady and secure flow of energy to China’s burgeoning economy and, in return, guarantees a consistent and robust revenue stream for the UAE’s diversifying energy sector, fostering economic resilience for both nations.

The industrial landscape of this partnership is characterized by the active involvement of key players from both nations, demonstrating a concerted effort to build a robust energy corridor. On the Chinese side, state-owned energy giants like China National Offshore Oil Corporation (CNOOC), which plays a pivotal role in China’s offshore oil and gas exploration and production, alongside influential privately controlled entities such as ENN Natural Gas, a major integrated energy company, and state energy trader Zhenhua Oil, are at the forefront of securing these vital LNG supplies. These companies are instrumental in negotiating and executing the multi-year, multi-billion-dollar contracts that underpin the energy trade, showcasing their strategic importance in China’s energy procurement. ADNOC, through its various specialized subsidiaries like ADNOC Trading, serves as the primary UAE counterpart, orchestrating the complex processes of production, liquefaction, and delivery of LNG to international markets. The strategic alignment, operational coordination, and long-term vision shared between these powerful entities are vital for the seamless and efficient functioning of this critical energy corridor, solidifying the industrial backbone of the New Silk Road Runs on Gas [3, 4].

IV. Recent Milestones and Strategic Shifts: A New Era of Partnership

The year 2025 has marked a significant acceleration in the China-UAE LNG partnership, signaling a new era of strategic alignment and deepened cooperation that extends far beyond mere commercial transactions. A symbolic and highly practical demonstration of this commitment was the inauguration of ADNOC’s Beijing office on April 18, 2025 [2]. This strategic move is more than just an expansion of physical presence; it is a clear statement of intent, designed to strengthen direct business relationships with Chinese customers and partners, streamline operational efficiencies, and foster closer collaboration at a strategic and diplomatic level. The office serves as a direct conduit for dialogue and partnership, underscoring the long-term vision both nations share for their energy future.

This commitment has rapidly translated into concrete, landmark LNG deals that are actively reshaping the global energy map and redefining supply chains. Among the most prominent is the 15-year sales and purchase agreement signed between ADNOC and ENN Natural Gas subsidiary ENN LNG (Singapore). This monumental agreement, heralded as the largest LNG deal ever between China and the UAE, will see ENN LNG receive up to 1 million metric tons per annum (MTPA) of LNG from ADNOC’s state-of-the-art, low-carbon Ruwais project, with deliveries commencing in 2028 [2]. This long-term commitment is a dual benefit: it provides crucial supply security and predictability for China’s rapidly growing energy needs, and it guarantees stable, long-term demand for the UAE, thereby underpinning significant infrastructure investments and fostering economic stability for both parties.

Further solidifying this burgeoning partnership, ADNOC Trading, a wholly-owned subsidiary of ADNOC, also inked two other significant LNG agreements. One was a substantial 5-year deal with China National Offshore Oil Corporation (CNOOC) Gas & Power Group, commencing in 2026, for 500,000 metric tons of LNG annually [1]. The other was a crucial term contract with state energy trader Zhenhua Oil [1]. These multiple agreements, involving diverse Chinese energy players ranging from state-owned behemoths to privately controlled enterprises, highlight a comprehensive and multi-pronged strategy by both nations to build a robust, resilient, and diversified energy supply chain that can withstand global market fluctuations and geopolitical pressures.

The strategic implications of these recent developments are profound and far-reaching. China’s proactive pursuit of LNG from the UAE is largely driven by a calculated and deliberate pivot away from U.S. LNG supplies. The ongoing tariff disputes and broader trade tensions between China and the United States have rendered American-sourced LNG economically less attractive and politically more precarious, prompting Chinese buyers to actively seek alternative, more stable, and cost-effective sources [1, 3]. The UAE, with its rapidly expanding production capacity, strategic geographical location, and a foreign policy emphasizing non-alignment and economic partnership, has emerged as a natural and highly willing partner in this critical diversification effort. This significant shift underscores a broader and undeniable trend in global energy markets where geopolitical considerations increasingly influence procurement strategies, favoring long-term, stable partnerships and reliable suppliers over reliance on potentially volatile or politically charged sources.

Moreover, these meticulously crafted deals signify a mutual preference for long-term, relationship-based energy trade over the more volatile and unpredictable spot markets. Such long-term contracts provide both producers and consumers with the essential certainty and stability required for massive capital investments in exploration, production, liquefaction, and regasification infrastructure. This stability is not merely an economic advantage; it is a hallmark of the deepening strategic partnership, reflecting a shared vision for energy security, economic resilience, and mutual prosperity that transcends mere commercial transactions and lays the groundwork for sustained collaboration in the decades to come. The commitment to these long-term agreements demonstrates a profound trust and shared strategic outlook between Beijing and Abu Dhabi.

V. Future Trajectory: Innovation, Sustainability, and Global Influence

The burgeoning LNG partnership between China and the UAE is not merely a response to current energy demands and geopolitical shifts; it is a forward-looking alliance poised to profoundly shape the future of global energy. Both nations are investing heavily in expanding their capabilities, exploring innovative solutions, and committing to sustainable practices, particularly in the realm of environmental stewardship and technological advancement.

China National Offshore Oil Corporation (CNOOC), a pivotal player in China’s energy landscape and this bilateral partnership, has articulated an ambitious target to significantly increase its LNG capacity to 35 million tons by 2030. This represents a substantial 75% increase from current levels [4], underscoring China’s unwavering commitment to natural gas as a crucial transitional fuel and a vital component of its long-term energy mix. This expansion is driven by the dual goals of meeting escalating domestic energy demand and reducing reliance on more carbon-intensive fuels. To achieve this ambitious target, CNOOC will continue to actively seek reliable international partners and secure diverse supply sources. The UAE, with its expanding production capabilities, strategic alignment, and commitment to long-term partnerships, remains a prime candidate for further collaboration, promising even deeper integration in the coming years.

Similarly, ADNOC, the UAE’s national oil company, is consistently investing in its LNG infrastructure, focusing on both upstream gas development and the expansion of its liquefaction and export facilities. The development of new liquefaction trains and the optimization of its entire supply chain are central to its strategy. The focus is not just on increasing volume but also on enhancing operational efficiency, integrating advanced technologies, and crucially, reducing the carbon footprint of its operations. This commitment aligns seamlessly with global efforts towards decarbonization and positions ADNOC as a responsible and sustainable energy provider, capable of meeting future energy demands with environmental consciousness.

Beyond conventional LNG trade, the future trajectory of China-UAE energy cooperation is increasingly focused on pioneering clean energy and low-carbon technologies. There is significant and untapped potential for collaboration in cutting-edge areas such as green LNG production, where renewable energy sources are harnessed to power the energy-intensive liquefaction processes, thereby significantly reducing emissions. Furthermore, joint ventures in Carbon Capture, Utilization, and Storage (CCUS) technologies present a compelling opportunity to mitigate the environmental impact of existing fossil fuel operations. Both nations recognize the imperative to mitigate climate change while simultaneously ensuring robust energy security. This shared understanding makes joint ventures in these advanced technologies a logical and necessary next step, fostering a synergistic approach to global energy challenges. The UAE’s proactive commitment to diversifying its energy mix and China’s globally recognized leadership in renewable energy deployment and technological innovation create exceptionally fertile ground for such collaborative and impactful initiatives.

From a geopolitical standpoint, the China-UAE LNG partnership serves as a compelling and influential model for South-South cooperation. It powerfully demonstrates how developing nations can forge robust, mutually beneficial alliances that not only contribute significantly to global energy security but also enhance economic stability, often independent of traditional Western-dominated energy frameworks. This collaboration enhances the collective influence and diplomatic leverage of both nations in international energy governance and actively fosters a more multipolar global energy landscape, where diverse voices and interests are represented. Their joint participation in influential international forums such as the United Nations and the rapidly expanding BRICS group further solidifies their commitment to promoting dialogue, multilateralism, and collaboratively addressing pressing global challenges like climate change, sustainable development, and regional stability through a shared vision [2]. The stability fostered by this deep and evolving partnership extends far beyond mere economic benefits, contributing significantly to regional peace and security in an increasingly complex and interconnected world. This strategic alignment underscores a shared belief in a cooperative global order, where energy is a bridge, not a wedge, source of division.

VI. Conclusion: A Resilient and Prosperous Partnership

The journey of China and the UAE, from ancient Silk Road traders to modern energy partners, culminates in a resilient and prosperous LNG alliance that is redefining global energy dynamics. This partnership, aptly described as the ‘New Silk Road Runs on Gas,’ is a testament to strategic foresight, mutual economic benefit, and a shared vision for a stable and sustainable energy future. Driven by China’s escalating demand for secure and cleaner energy and the UAE’s ambition to diversify its economy and solidify its position as a global energy hub, their collaboration has transcended mere commercial transactions to become a cornerstone of their comprehensive strategic partnership.

The historical foundations, rooted in millennia of cultural and commercial exchange, have provided a robust framework for contemporary diplomatic and economic ties. The industrial imperative, characterized by China’s energy security needs and the UAE’s strategic supply ambitions, has led to landmark long-term LNG agreements that ensure stability for both nations. These recent milestones, including the inauguration of ADNOC’s Beijing office and multi-year contracts with major Chinese energy players, underscore a deliberate and strategic shift towards deeper bilateral engagement, particularly as China diversifies its energy sources away from politically sensitive suppliers.

Looking ahead, the future trajectory of this partnership is marked by continued expansion, innovation, and a growing emphasis on sustainability. Both nations are committed to advancing clean energy technologies and reducing the carbon footprint of LNG production, paving the way for potential collaborations in green LNG and CCUS. Beyond economics, this alliance serves as a powerful example of South-South cooperation, contributing to global energy security, fostering multilateralism, and enhancing stability in an increasingly complex world.

In essence, the China-UAE LNG partnership is more than just a series of energy deals; it is a vibrant, evolving relationship that promises enduring prosperity and stability for both nations and plays a crucial role in shaping the global energy landscape for decades to come. It is a partnership built on trust, shared objectives, and a forward-looking perspective, truly embodying the spirit of a new Silk Road, powered by gas.

References

[1] Chen Aizhu. (2025, April 21). China’s CNOOC agrees LNG deal with UAE’s Adnoc amid tariff war with US. Reuters. https://www.reuters.com/business/energy/chinas-cnooc-agrees-lng-deal-with-uaes-adnoc-amid-tariff-war-with-us-2025-04-21/

[2] Yang Chuanli. (2025, April 21). UAE and China deepen energy cooperation. China.org.cn. http://www.china.org.cn/business/2025-04/21/content_117835605.htm

[3] Staff. (2025, April 23). China Signs Major LNG Deals With UAE to Replace U.S. Supply. RealClearEnergy. https://www.realclearenergy.org/2025/04/23/china_signs_major_lng_deals_with_uae_to_replace_us_supply_1105445.html

[4] WAM. (2024, June 3). 40 Years of UAE & China: Towards Global Cooperation & Economic Growth. Emirates News Agency. https://www.wam.ae/en/article/13y4lco-years-uae-china-towards-global-cooperation