From ‘Made in China’ to ‘Co-Created in the UAE’: The Evolution of Chinese High-Tech Manufacturing in the Emirates.

Executive Summary

The UAE and China have forged a rapidly evolving strategic partnership, moving from traditional trade to advanced technological and industrial cooperation. Bilateral trade reached a record $101.8 billion in 2024, an 800-fold increase since 1984, with China remaining the UAE’s largest trading partner. This deepening relationship, established in 2018, is shifting from a ‘Made in China’ import model to a ‘Co-Created in the UAE’ paradigm, particularly in high-tech manufacturing and innovation. Key sectors driving this evolution include energy, infrastructure, AI, digital transformation, healthcare, and advanced logistics. The UAE’s strategic location, proactive investment policies, and free zones position it as a critical hub for Chinese enterprises seeking regional expansion and collaborative development. This article explores the dynamic landscape, highlighting growth drivers, opportunities, and critical considerations for sustained, mutually beneficial progress.

Introduction

The relationship between the United Arab Emirates (UAE) and China has blossomed into a comprehensive strategic partnership, characterized by burgeoning economic ties and a shared vision for innovation and sustainable development. This evolution is particularly evident in the transformation of Chinese engagement within the Emirates, moving beyond a traditional export-oriented model—epitomized by the phrase ‘Made in China’—towards a more integrated and collaborative approach: ‘Co-Created in the UAE’. This paradigm shift reflects the UAE’s ambitious economic diversification agenda, which prioritizes high-tech industries, advanced manufacturing, and knowledge-based economies, aligning seamlessly with China’s global technological aspirations and its Belt and Road Initiative (BRI).

This article delves into the multifaceted dimensions of this evolving partnership, examining how Chinese high-tech manufacturing is increasingly finding a home and fostering joint innovation within the UAE. We will explore the historical trajectory of bilateral cooperation, analyze the current landscape of strategic investments and sectoral collaborations, and identify the key opportunities and drivers propelling this transformation. Furthermore, the article will address the challenges and critical considerations inherent in such a dynamic partnership, present a compelling case study, and offer strategic recommendations for future growth. Ultimately, this analysis aims to illuminate the profound implications of this ‘Co-Created in the UAE’ phenomenon for both nations and the broader global economic landscape.

The Current Landscape of Bilateral Cooperation

The economic and strategic ties between the UAE and China have reached unprecedented levels, transforming the regional and global trade landscape. This robust partnership is underpinned by significant trade volumes, strategic agreements, and a growing presence of Chinese enterprises within the Emirates.

Key Statistics and Trade Data

The bilateral trade volume between the UAE and China soared to a record $101.8 billion in 2024, representing an astonishing 800-fold increase since 1984. This makes the UAE China’s largest export market in the Middle East and its second-largest trading partner in the region. China has consistently remained the UAE’s largest trading partner, underscoring the deep interdependence of their economies. Over 15,000 Chinese firms now operate across various sectors in the UAE. Furthermore, UAE investments in China have seen substantial growth, reaching $4.5 billion by the end of 2023, a remarkable 96% increase from the previous year. These figures highlight a dynamic and expanding economic relationship that extends beyond mere commodity exchange to encompass significant capital flows and business integration.

Strategic Partnership Framework

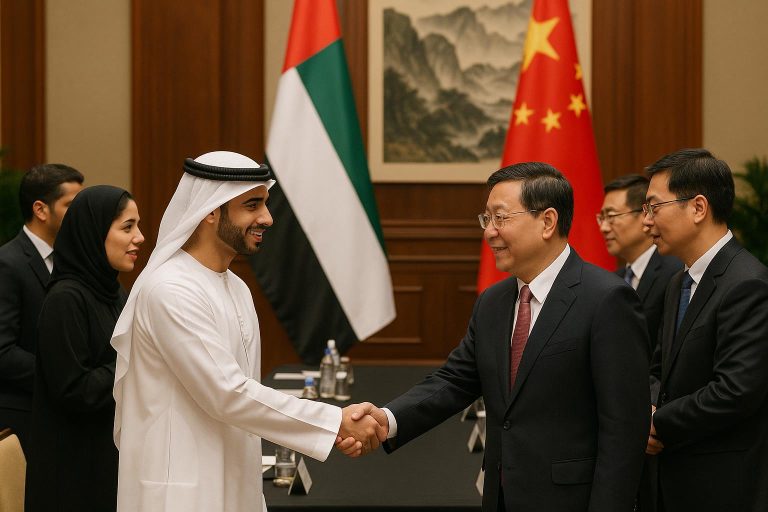

At the heart of this deepening relationship is the comprehensive strategic partnership established in 2018. This framework provides a robust foundation for enhanced cooperation across political, economic, and cultural spheres. Practical mechanisms, such as the UAE-China Investment and Economic Cooperation Working Group, facilitate dialogue and coordination on key initiatives. Regular high-level diplomatic engagements and the signing of strategic agreements further solidify this partnership, ensuring alignment on regional and international issues and fostering an environment conducive to sustained growth and collaboration.

Key Cooperation Sectors Identified

The collaboration between the UAE and China spans a diverse array of strategic sectors, reflecting both nations’ developmental priorities:

- Energy & Clean Energy: Investments in solar energy and wind power are prominent, exemplified by the MoU between Masdar and the China Silk Road Fund for renewable energy projects within Belt and Road Initiative (BRI) countries.

- Infrastructure & Logistics: Projects like the COSCO terminal at Khalifa Port and the China-UAE Industrial Capacity Zone are pivotal, positioning the UAE as China’s gateway to the Gulf and beyond. DP World’s collaborations further enhance this logistical synergy.

- Technology & AI: Cooperation agreements and digital transformation initiatives are fostering innovation, with a particular focus on artificial intelligence and smart city solutions.

- Trade & Free Zones: The UAE’s world-class free zones, such as JAFZA, have forged significant partnerships with Chinese free trade zones, facilitating trade, investment, and the establishment of Chinese enterprises.

- Finance & Investment: The Belt and Road Initiative (BRI) has channeled substantial investments into the UAE, with projects totaling $3.1 billion. Cross-border investment facilitation mechanisms are also being strengthened.

Geographic Focus Areas

While cooperation is widespread, certain geographic areas within the UAE play distinct roles:

- Abu Dhabi has emerged as a primary investment hub, attracting significant Chinese capital.

- Dubai continues to serve as a crucial center for trade facilitation, logistics, and tourism.

- Free zone partnerships across various emirates are instrumental in providing specialized environments for Chinese businesses, fostering industrial capacity and technological innovation, truly embodying the spirit of ‘Co-Created in the UAE’.

Opportunities and Strategic Growth Drivers

The deepening UAE-China partnership is characterized by a proactive pursuit of new opportunities and strategic growth drivers that extend beyond traditional trade into advanced and emerging sectors. This forward-looking approach is evident in recent developments and the expansion into diverse cooperation areas.

Recent Developments (2024-2025)

The period of 2024-2025 has witnessed a significant acceleration in bilateral engagements, signaling a robust trajectory for future collaboration. Multiple Memoranda of Understanding (MoUs) have been signed between various chambers and organizations, laying the groundwork for enhanced cooperation across numerous industries. High-level visits and diplomatic engagements continue to reinforce political will and mutual trust, creating a stable environment for investment and partnership. A particular focus has been placed on new economy sectors, entrepreneurship, tourism, and aviation, reflecting both nations’ commitment to economic diversification and innovation-driven growth. These developments are not merely transactional but represent a strategic alignment of national visions, with the UAE’s economic ambitions finding resonance with China’s global outreach.

Additional Key Cooperation Sectors

Beyond the established areas, several emerging sectors are proving to be powerful strategic growth drivers. In Healthcare & Pharmaceuticals, Mubadala’s acquisition of UCB Pharma’s mature business in China demonstrates a strong interest in the Chinese pharmaceutical market. Broader cooperation includes medical technology and pharmaceutical partnerships, with investment opportunities across hospitals, pharmaceutical manufacturing, biotechnology, and medical devices, aligning with the UAE’s vision to become a regional healthcare hub. Addressing global food security concerns, the UAE and China are strengthening Agriculture & Food Security cooperation, exemplified by the $33 million smart agricultural project between Silal and China’s Shouguang Vegetable Group, focusing on hydroponics and modern agriculture. China’s SVG is further investing over AED 120 million in a 100,000m² Agritech facility in Al Ain.

The Aviation & Transportation sector is experiencing significant growth in bilateral ties, with Emirates and Air China’s MoU for enhanced partnership and route expansion boosting connectivity. A landmark $1 billion deal for 350 flying taxis (eVTOL aircraft) highlights a shared vision for future mobility. The GCAA’s collaboration with China and Emirates’ network expansion underscore the strategic importance of air travel and logistics. The UAE is also solidifying its position as a critical Logistics & Supply Chain hub for China-Middle East trade, with JINGDONG Property’s establishment of its first Middle East logistics hub in Dubai and JD.com’s implementation of smart supply chain technologies. Partnerships with DP World further integrate supply chains, enhancing efficiency and connectivity.

In Artificial Intelligence & Digital Transformation, a $5 billion partnership between the UAE and China for AI, renewable energy, and infrastructure signifies a major commitment to advanced technologies. G42 is strategically positioned for global AI collaboration, and Digital Dubai’s exploration of AI and smart city technologies in Shenzhen illustrates the UAE’s proactive approach to leveraging AI investments for global influence. The Tourism & Hospitality sector is poised for substantial growth, with the 2025 China-GCC tourism trade fair in Dubai aiming to capitalize on a $1 billion tourism opportunity from China. China Tourism Group is actively exploring investments in the UAE’s hospitality sector, including tourist resorts, shopping centers, and hospitality infrastructure. Finally, Financial Services & Fintech collaboration is expanding, with China’s Cross-border Interbank Payment System (CIPS) and the UAE Central Bank cooperating on cross-border payments. Abu Dhabi-China fintech partnerships, ETF launches, and cross-border payment connectivity programs facilitate greater financial integration and innovation between the two economies.

Challenges and Critical Considerations

While the trajectory of UAE-China high-tech manufacturing collaboration is overwhelmingly positive, a comprehensive analysis necessitates acknowledging potential challenges and critical considerations that could influence its sustained growth and effectiveness. Addressing these proactively will be crucial for solidifying the ‘Co-Created in the UAE’ paradigm.

One significant area of consideration lies in regulatory harmonization and intellectual property (IP) protection. As Chinese high-tech firms increasingly establish R&D and manufacturing bases in the UAE, navigating differing legal frameworks and ensuring robust IP safeguards becomes paramount. Continuous efforts are required to align regulatory standards and build trust, particularly in sensitive high-tech sectors, including clarity on data governance, cybersecurity protocols, and technology transfer mechanisms.

Another critical aspect is talent development and cultural integration. The influx of Chinese companies and expertise requires a skilled local workforce capable of engaging with advanced manufacturing processes and technologies. Bridging cultural differences in business practices, management styles, and communication is essential for fostering truly collaborative and innovative environments. Investment in joint educational programs, vocational training, and cross-cultural exchange initiatives can mitigate these challenges.

Furthermore, the geopolitical landscape and global supply chain dynamics present external considerations. The UAE maintains strong relationships with various global powers, and its strategic partnerships, including with China, are often viewed through a broader international lens. Ensuring that bilateral cooperation remains resilient to geopolitical shifts and avoids potential entanglements requires careful diplomatic navigation. Diversifying supply chains and building local capabilities can also enhance the resilience of high-tech manufacturing ventures.

Finally, market competition and differentiation within the UAE’s rapidly developing industrial sector must be considered. As more players enter the high-tech manufacturing space, Chinese and Emirati partners will need to continuously innovate and differentiate their offerings to maintain competitive advantages. This involves focusing on niche markets, developing unique technological solutions, and leveraging the UAE’s strategic access to regional and international markets.

Case Study Spotlight: The China-UAE Industrial Capacity Cooperation Demonstration Zone

A compelling illustration of the shift from ‘Made in China’ to ‘Co-Created in the UAE’ is the China-UAE Industrial Capacity Cooperation Demonstration Zone in Khalifa Port, Abu Dhabi. This ambitious project, a cornerstone of the Belt and Road Initiative, exemplifies the strategic collaboration aimed at fostering advanced manufacturing and industrial innovation within the Emirates. Developed by Jiangsu Provincial Overseas Cooperation and Investment Company (JOCIC) and Abu Dhabi Ports, the zone is designed to attract Chinese high-tech and manufacturing enterprises to establish their regional headquarters, production facilities, and research and development centers in the UAE.

The zone offers a comprehensive ecosystem, including state-of-the-art infrastructure, logistics support, and a business-friendly regulatory environment. It has successfully drawn investments in diverse high-tech sectors, ranging from new energy and advanced materials to biotechnology and smart manufacturing. Companies setting up operations here benefit from the UAE’s strategic geographic location, access to regional markets, and a skilled workforce, while contributing to the UAE’s economic diversification goals. This initiative not only facilitates the transfer of advanced Chinese manufacturing capabilities and technological know-how to the UAE but also creates a platform for joint innovation, local job creation, and the development of a robust industrial base, truly embodying the spirit of co-creation.

Future Outlook and Strategic Recommendations

The future of UAE-China high-tech manufacturing collaboration is poised for continued expansion, driven by shared economic visions and complementary strengths. The transition from a transactional ‘Made in China’ model to a collaborative ‘Co-Created in the UAE’ paradigm is a strategic imperative for both nations.

Future Outlook:

We anticipate accelerated growth in sectors suchs as Artificial Intelligence, clean energy technologies, advanced robotics, and biotechnology. The UAE’s proactive investment in digital infrastructure and its ambition to become a global AI leader, coupled with China’s technological prowess, will likely lead to more joint ventures, R&D centers, and localized high-tech production facilities. The UAE will further solidify its role as a strategic gateway for Chinese enterprises into the MENA region, fostering an environment where innovation is jointly developed and scaled.

Strategic Recommendations:

To maximize the potential of this partnership, several strategic recommendations are pertinent:

- Enhance Policy Alignment: Harmonize regulatory frameworks, particularly concerning intellectual property rights, data governance, and investment incentives, to create a predictable and attractive environment.

- Invest in Human Capital: Prioritize joint educational and vocational training programs focused on advanced manufacturing skills, AI, and digital technologies to cultivate a local talent pool.

- Diversify Investment Portfolios: Encourage further diversification of Chinese investments into emerging high-tech sectors within the UAE, exploring new frontiers like space technology and sustainable agriculture.

- Promote Innovation Ecosystems: Foster greater collaboration between UAE and Chinese universities, research institutions, and startups to create vibrant innovation ecosystems that drive cutting-edge research and commercialization.

- Strengthen Financial Connectivity: Expand fintech partnerships and cross-border payment solutions to facilitate seamless financial transactions and investment flows, supporting bilateral trade and investment.

Conclusion

The China-UAE economic narrative has evolved significantly, moving from a simple buyer-seller dynamic to a sophisticated partnership defined by co-creation and mutual strategic development. This transformation, from a focus on ‘Made in China’ exports to ‘Co-Created in the UAE’ high-tech manufacturing, signifies a mature and forward-looking alliance. It is driven by record bilateral trade, strategic agreements, and a shared commitment to innovation across critical sectors like clean energy, AI, advanced logistics, and sustainable agriculture. The UAE’s strategic vision for economic diversification, coupled with its world-class infrastructure and business-friendly environment, provides an ideal platform for Chinese enterprises to localize, innovate, and expand their high-tech manufacturing footprint. While challenges in regulatory harmonization, talent development, and geopolitical dynamics persist, proactive engagement and strategic alignment between the two nations promise a robust pathway for overcoming these hurdles. The future envisions deeper integration, with the UAE serving as a vital hub for Chinese technological advancement and a model for international industrial collaboration, contributing to shared prosperity and global innovation.

References

[1] UAE-China Bilateral Investment Research Findings (Provided Research Data)