Beyond the Barrel: A Deep Dive into Chinese Investments in the UAE’s Solar and Green Hydrogen Sectors.

Executive Summary

This article explores the burgeoning partnership between China and the United Arab Emirates (UAE) in the critical sectors of solar energy and green hydrogen, moving beyond traditional hydrocarbon-based cooperation. Driven by a comprehensive strategic partnership established in 2018, bilateral trade reached a record $101.8 billion in 2024, with significant investments flowing into new economy sectors. China, as the UAE’s largest trading partner, and the UAE, as China’s largest export market in the Middle East, are strategically aligning their energy transition goals. Key initiatives like the Masdar-China Silk Road Fund MoU underscore a shared commitment to renewable energy projects within the Belt and Road Initiative. While opportunities abound in technological collaboration, infrastructure development, and cross-border investment facilitation, the article also critically examines challenges such as market integration and regulatory harmonization. Ultimately, this partnership is poised to accelerate both nations’ sustainable development agendas, positioning the UAE as a pivotal hub for green energy innovation and investment in the region.

Introduction

The relationship between the United Arab Emirates (UAE) and China has evolved significantly, transcending traditional economic ties to embrace a comprehensive strategic partnership. While historically rooted in oil and gas trade, the focus has increasingly shifted towards diversified sectors, particularly renewable energy. This article delves into the intricate landscape of Chinese investments in the UAE’s solar and green hydrogen sectors, examining the strategic motivations, mutual benefits, and inherent challenges of this collaboration. As both nations embark on ambitious sustainability agendas – China aiming for carbon neutrality by 2060 and the UAE targeting Net Zero by 2050 – their convergence in clean energy technologies presents a powerful synergy. This analysis will explore how Chinese capital, technology, and expertise are catalyzing the UAE’s transition to a green economy, positioning the Emirates as a regional leader in renewable energy innovation. We will scrutinize the current state of bilateral cooperation, identify key opportunities and strategic growth drivers, address critical considerations, and highlight a compelling case study, ultimately offering a future outlook and strategic recommendations for sustained partnership.

The Current Landscape of Bilateral Cooperation

The relationship between the UAE and China has witnessed unprecedented growth, evolving into a robust comprehensive strategic partnership. This deepening alliance is evident in the remarkable expansion of bilateral trade and investment. In 2024, bilateral trade volume soared to a record $101.8 billion, representing an astonishing 800-fold increase since 1984. The UAE has solidified its position as China’s largest export market in the Middle East and its second-largest trading partner in the region, while China consistently remains the UAE’s largest trading partner. This economic interdependence is further highlighted by the presence of over 15,000 Chinese firms operating within the UAE, underscoring the Emirates’ role as a vital commercial hub for Chinese enterprises. Concurrently, UAE investments in China have also seen a significant uptick, reaching $4.5 billion by the end of 2023, marking a 96% increase from the previous year.

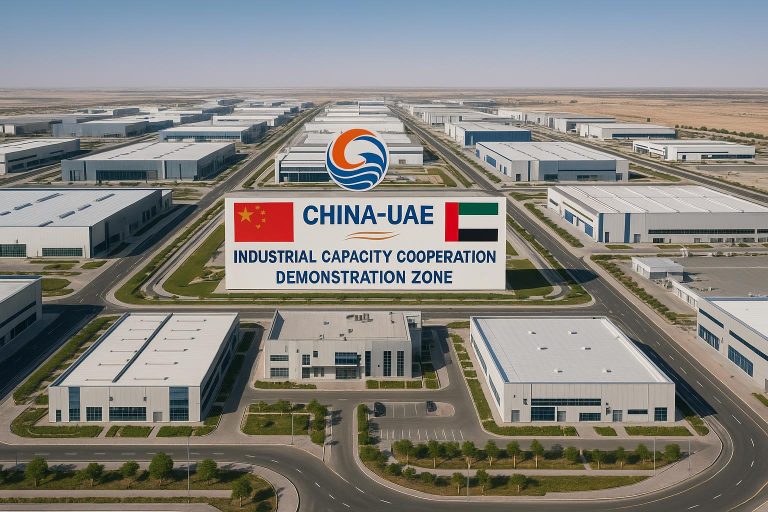

This strategic alignment is underpinned by a formal framework established with the Comprehensive Strategic Partnership in 2018 and the formation of the UAE-China Investment and Economic Cooperation Working Group. These mechanisms facilitate regular high-level diplomatic engagements and the signing of strategic agreements, fostering an environment conducive to cross-sector collaboration. While traditional sectors like infrastructure and logistics (e.g., COSCO terminal at Khalifa Port, China-UAE Industrial Capacity Zone) continue to thrive, the partnership has significantly diversified into new economy sectors.

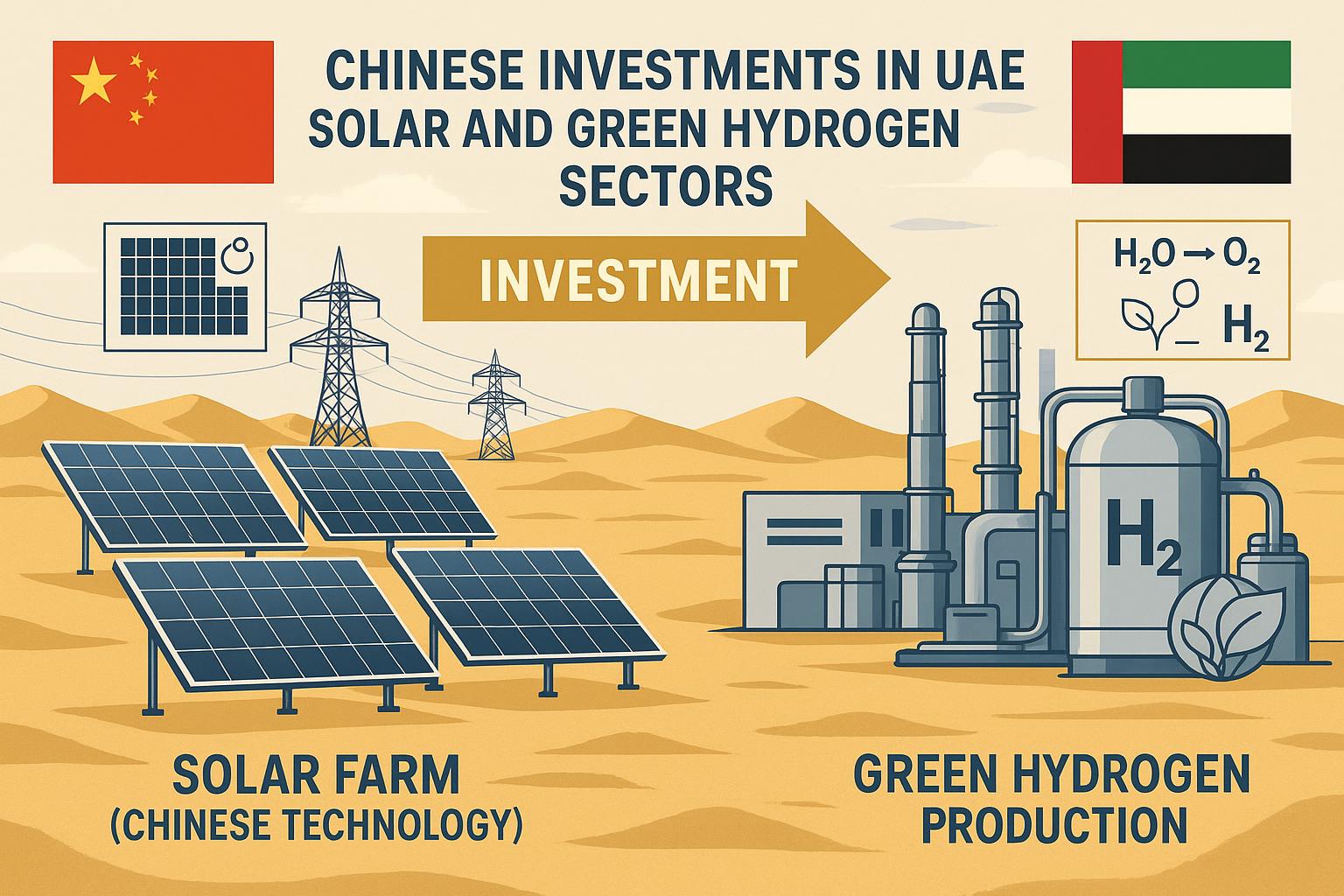

Crucially, Energy & Clean Energy has emerged as a cornerstone of this cooperation. Both nations recognize the imperative of transitioning to sustainable energy sources. Chinese investments and technological expertise are increasingly channeled into the UAE’s ambitious solar energy and green hydrogen initiatives. A prime example of this collaboration is the Masdar-China Silk Road Fund Memorandum of Understanding (MoU), which aims to jointly develop renewable energy projects in Belt and Road Initiative (BRI) countries. This partnership extends beyond mere financial investment, encompassing technology transfer, joint research, and development in areas critical for the energy transition.

Beyond energy, cooperation spans Technology & AI, with agreements focusing on digital transformation; Trade & Free Zones, exemplified by JAFZA’s partnerships with Chinese free trade zones and DP World collaborations; and Finance & Investment, where BRI projects alone account for $3.1 billion in the UAE. Recent developments in 2024-2025 further solidify this trend, with multiple MoUs signed across various chambers and organizations, alongside high-level visits emphasizing new economy sectors, entrepreneurship, tourism, and aviation. Geographically, Abu Dhabi serves as a primary investment hub, while Dubai plays a crucial role in trade facilitation, with free zones across the emirates fostering diverse partnerships. This multifaceted engagement paints a picture of a dynamic and expanding bilateral relationship, increasingly focused on sustainable and high-tech sectors.

Opportunities and Strategic Growth Drivers

The burgeoning partnership between China and the UAE in solar and green hydrogen is propelled by a confluence of strategic opportunities and powerful growth drivers, benefiting both nations. The UAE, with its abundant solar resources, strategic geographical location, and ambitious clean energy targets, presents an ideal landscape for Chinese investment and technological collaboration. China, in turn, brings unparalleled expertise in renewable energy manufacturing, advanced technology, and significant capital, making it a crucial partner in the UAE’s energy transition.

One of the primary drivers is the UAE’s commitment to energy diversification and sustainability. The nation aims for Net Zero by 2050, necessitating massive investments in renewable energy. Its National Energy Strategy 2050 targets a 50% clean energy mix, with solar power playing a pivotal role. This creates a robust demand for solar photovoltaic (PV) technology, energy storage solutions, and green hydrogen production facilities, areas where Chinese companies hold a competitive edge. The Masdar-China Silk Road Fund MoU exemplifies this synergy, channeling Chinese investment into renewable energy projects not only within the UAE but also across BRI countries, leveraging the UAE’s position as a regional clean energy hub.

Furthermore, the Belt and Road Initiative (BRI) serves as a significant strategic framework, facilitating cross-border investment and infrastructure development. With $3.1 billion in BRI projects already in the UAE, the initiative provides a platform for expanding cooperation in green infrastructure. Chinese companies can utilize the UAE’s world-class logistics and infrastructure, including the COSCO terminal at Khalifa Port and the China-UAE Industrial Capacity Zone, to establish regional manufacturing and distribution hubs for renewable energy components. This positions the UAE as a critical gateway for Chinese green technologies into the wider Middle East and Africa.

Technological collaboration and innovation are also key growth drivers. The UAE’s focus on Technology & AI and digital transformation aligns perfectly with China’s advancements in these fields. Partnerships in smart grid technologies, AI-driven energy management systems, and advanced materials for solar panels and hydrogen electrolyzers can accelerate the development and deployment of cutting-edge solutions. The $5 billion partnership for AI, renewable energy, and infrastructure between the UAE and China underscores this commitment, fostering an ecosystem for innovation.

Moreover, the UAE’s robust financial services and fintech sector offers attractive avenues for facilitating these investments. Initiatives like Abu Dhabi-China fintech partnerships and cross-border payment cooperation with China’s CIPS can streamline financial transactions and attract further capital for large-scale green projects. The presence of over 15,000 Chinese firms in the UAE, coupled with the UAE’s increasing investments in China (reaching $4.5 billion by end of 2023), indicates a strong foundation of mutual trust and economic integration that can be leveraged for green investments.

Finally, the UAE’s proactive stance in fostering a business-friendly environment, including its numerous free zones and supportive regulatory frameworks, significantly enhances its appeal to Chinese investors. These zones offer incentives, ease of doing business, and access to a skilled workforce, making them ideal locations for establishing green energy ventures. The strategic geographic focus on Abu Dhabi as a primary investment hub and Dubai’s role in trade facilitation further amplifies these opportunities, creating a dynamic environment for Chinese capital and expertise to drive the UAE’s solar and green hydrogen ambitions.

Challenges and Critical Considerations

While the collaboration between China and the UAE in solar and green hydrogen sectors presents immense opportunities, it is not without its challenges and critical considerations that require careful navigation to ensure sustained success. A primary consideration revolves around market integration and regulatory harmonization. Despite the robust bilateral trade and investment frameworks, differences in regulatory environments, legal systems, and business practices can pose hurdles for Chinese companies operating in the UAE and vice versa. Ensuring seamless integration of technologies and adherence to local standards, particularly in nascent sectors like green hydrogen, demands continuous dialogue and policy alignment.

Another critical aspect is geopolitical dynamics and global supply chain resilience. The clean energy sector, especially solar PV and green hydrogen technologies, is increasingly intertwined with global geopolitical considerations. Diversifying supply chains, ensuring access to critical raw materials, and mitigating potential disruptions become paramount. Both nations must strategically manage their dependencies and foster a resilient ecosystem that can withstand external pressures. This includes fostering local manufacturing capabilities within the UAE and exploring joint ventures that enhance self-sufficiency.

Furthermore, technological transfer and intellectual property (IP) protection require careful attention. While China brings advanced manufacturing capabilities and technological prowess, ensuring equitable technology transfer and robust IP protection mechanisms is crucial for fostering trust and encouraging deeper collaboration. Clear frameworks for joint research and development, as well as commercialization of innovations, are essential to prevent disputes and maximize mutual benefits.

Finally, human capital development and cultural integration play a significant role. The rapid expansion of Chinese firms in the UAE, with over 15,000 operating there, necessitates a focus on developing local talent in clean energy technologies and fostering cultural understanding. Bridging language barriers and promoting cross-cultural management practices will be vital for the long-term success of joint ventures and projects. Addressing these considerations proactively will strengthen the foundation of the UAE-China partnership, ensuring it remains robust and mutually beneficial in the evolving global energy landscape.

Case Study Spotlight: Masdar and China Silk Road Fund MoU

A compelling illustration of the deepening collaboration between China and the UAE in the renewable energy sector is the Memorandum of Understanding (MoU) between Masdar and the China Silk Road Fund. Masdar, Abu Dhabi’s flagship renewable energy company, has been at the forefront of the UAE’s clean energy transition. The partnership with the China Silk Road Fund, a state-owned investment fund established to support the Belt and Road Initiative (BRI), signifies a strategic alignment of capital and expertise towards sustainable development.

This MoU focuses on jointly developing renewable energy projects in BRI countries. While not exclusively limited to the UAE, it leverages Masdar’s extensive experience in developing large-scale solar and wind projects globally, combined with the China Silk Road Fund’s financial muscle and strategic vision for the BRI. This collaboration facilitates the deployment of Chinese technology and investment into renewable energy infrastructure, not only within the UAE but also across a broader geographical footprint that includes emerging markets along the Belt and Road. It underscores the UAE’s role as a pivotal hub for green finance and project development, attracting Chinese capital to advance global energy transition goals. This case study exemplifies how the comprehensive strategic partnership translates into tangible projects that drive both economic growth and environmental sustainability.

Future Outlook and Strategic Recommendations

The future trajectory of Chinese investments in the UAE’s solar and green hydrogen sectors appears exceptionally promising, poised to further solidify the comprehensive strategic partnership between the two nations. The UAE’s ambitious Net Zero by 2050 target, coupled with China’s global leadership in renewable energy technology and manufacturing, creates a powerful synergy for continued growth. We can anticipate an acceleration of joint ventures in large-scale solar farms and innovative green hydrogen production facilities, particularly in Abu Dhabi, which is emerging as a key investment hub.

To maximize the potential of this partnership, several strategic recommendations are pertinent. Firstly, both nations should prioritize the establishment of a dedicated UAE-China Green Energy Innovation Fund. This fund could co-invest in R&D for next-generation solar technologies, advanced electrolysis, and hydrogen storage solutions, fostering a collaborative innovation ecosystem. Secondly, there is a need for enhanced regulatory alignment and standardization to streamline project approvals and facilitate cross-border investment flows, addressing the challenges of market integration. This could involve joint working groups focused on harmonizing technical standards for green hydrogen production and certification.

Thirdly, focusing on human capital development through joint educational programs and vocational training in renewable energy technologies will be crucial. This ensures a skilled workforce capable of supporting the burgeoning green economy. Finally, leveraging the Belt and Road Initiative more explicitly for green infrastructure projects, beyond traditional sectors, will further integrate the UAE into China’s global sustainability vision, positioning it as a critical node for green energy trade and innovation in the Middle East and beyond.

Conclusion

The strategic partnership between the UAE and China is rapidly evolving, with a pronounced shift towards sustainable energy sectors like solar and green hydrogen. This collaboration, underpinned by robust economic ties and a shared vision for a green future, is proving instrumental in advancing the UAE’s energy transition goals. Chinese investments and technological expertise are not only facilitating the deployment of large-scale renewable energy projects but also fostering innovation and economic diversification within the Emirates. While challenges related to market integration, geopolitical dynamics, and intellectual property protection exist, proactive engagement and strategic planning can mitigate these risks. The continued synergy between China’s industrial might and the UAE’s strategic vision positions this partnership as a powerful force for global sustainable development, setting a precedent for future international collaborations in the clean energy landscape.

References

[1] Bilateral trade statistics and investment data from official sources (e.g., UAE Ministry of Economy, China Ministry of Commerce).

[2] Masdar official statements and press releases regarding partnerships and projects.

[3] UAE National Energy Strategy 2050 and Net Zero by 2050 initiatives.

[4] Reports and analyses from reputable financial institutions and research organizations on Belt and Road Initiative investments.

[5] News articles and official reports detailing recent developments in UAE-China cooperation in clean energy and technology.