A Tale of Two Financial Hubs: Synergies and Strategic Competition Between the UAE and Hong Kong in Attracting Chinese Capital

Executive Summary

This article examines the evolving roles of the United Arab Emirates (UAE) and Hong Kong as pivotal financial hubs in attracting the burgeoning flow of Chinese capital. With bilateral trade between the UAE and China reaching a record $101.8 billion in 2024, and UAE investments in China increasing by 96% to $4.5 billion, the UAE has emerged as a significant partner in China’s global economic strategy. Concurrently, Hong Kong maintains its historical position as a crucial gateway for Chinese outbound and inbound investment, facilitating two-thirds of China’s foreign direct investment and outward direct investment. The analysis reveals that while both hubs offer distinct advantages—the UAE through its strategic location, diversification efforts, and alignment with the Belt and Road Initiative, and Hong Kong through its established financial infrastructure, unique access to mainland markets, and role in RMB internationalization—they also face challenges including regulatory complexities and geopolitical shifts. The article explores potential synergies, such as complementary market access and shared BRI financing expertise, alongside strategic competition, ultimately providing recommendations for both regions to enhance their attractiveness and foster deeper financial integration with China.

Introduction

The global economic landscape is undergoing a profound transformation, characterized by the increasing influence of Chinese capital flows. As China continues its trajectory as a global economic powerhouse, its outbound and inbound investments are reshaping international finance and trade. In this dynamic environment, two distinct yet strategically important financial hubs—the United Arab Emirates (UAE) and Hong Kong—have emerged as key players in attracting and facilitating Chinese capital. The relationship between China and the UAE has witnessed exponential growth, with bilateral trade soaring to a record $101.8 billion in 2024, marking an astounding 800-fold increase since 1984. This makes the UAE China’s largest export market in the Middle East and its second-largest trading partner in the region, while China remains the UAE’s largest trading partner. Similarly, UAE investments in China have seen a remarkable 96% increase, reaching $4.5 billion by the end of 2023. This article aims to provide a comprehensive analysis of the synergies and strategic competition between the UAE and Hong Kong in their efforts to attract Chinese capital. It will delve into their respective strengths, examine the opportunities and challenges they face, and offer strategic recommendations for fostering deeper engagement with Chinese investors, ultimately contributing to a more integrated and prosperous global financial ecosystem.

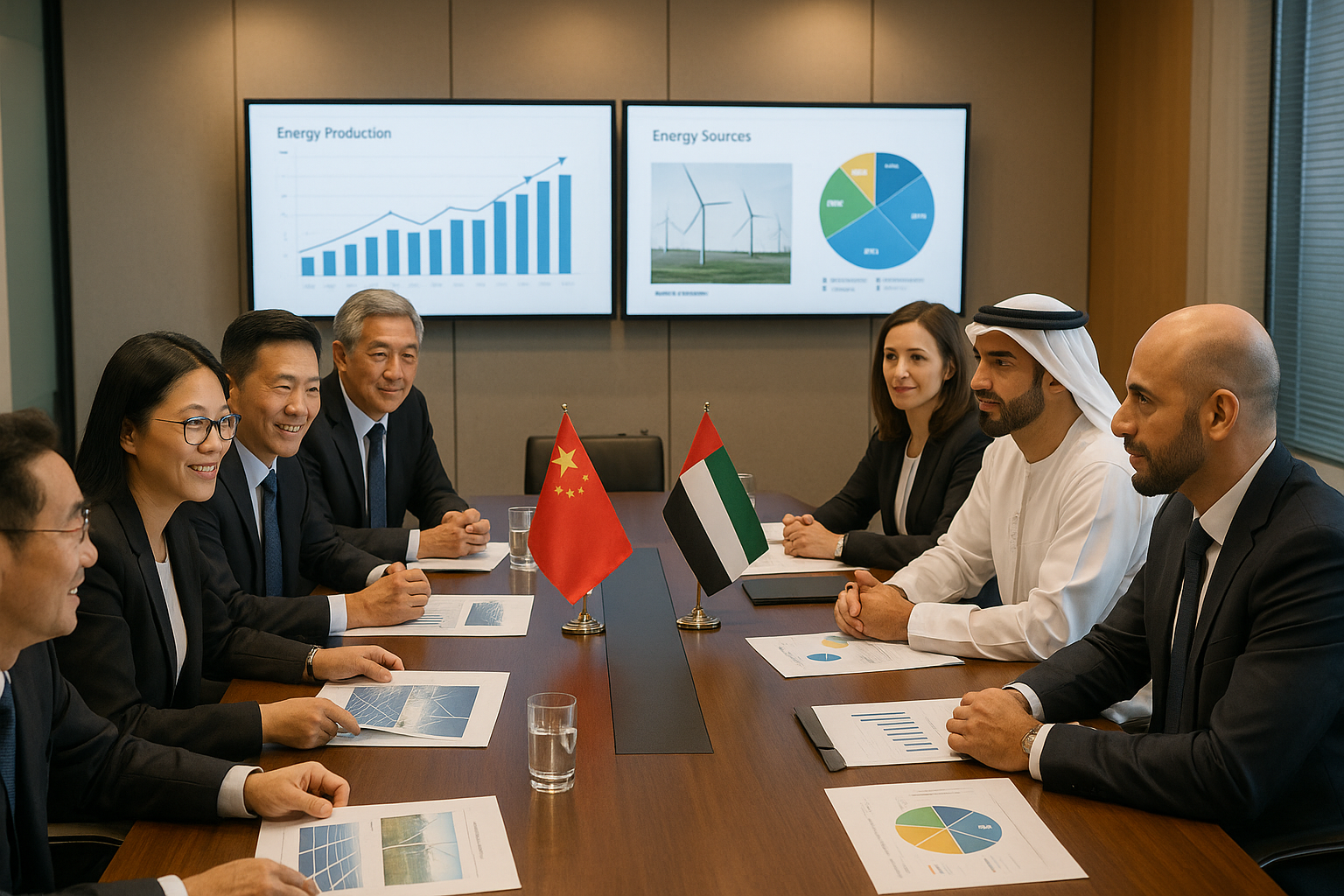

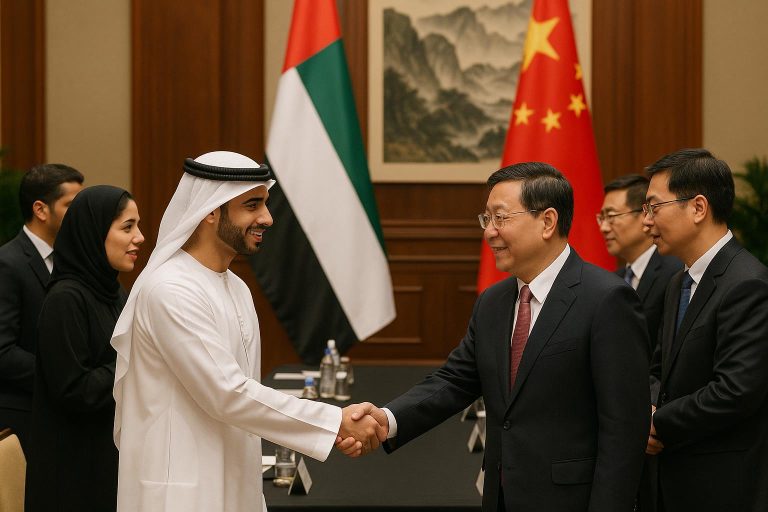

The Current Landscape of Bilateral Cooperation

The economic and financial ties between China and the United Arab Emirates have deepened significantly, evolving into a comprehensive strategic partnership established in 2018. This partnership is underpinned by robust trade and investment flows, with bilateral trade reaching an unprecedented $101.8 billion in 2024, an 800-fold increase since 1984. The UAE is China’s largest export market in the Middle East and its second-largest trading partner in the region, while China remains the UAE’s largest trading partner. Over 15,000 Chinese firms operate in the UAE, and UAE investments in China surged to $4.5 billion by the end of 2023, a 96% increase from the previous year.

This strategic alignment is fostered through mechanisms like the UAE-China Investment and Economic Cooperation Working Group and regular high-level diplomatic engagements. Cooperation spans diverse sectors including Energy & Clean Energy (solar, wind, Masdar-China Silk Road Fund MoU), Infrastructure & Logistics (COSCO terminal at Khalifa Port, China-UAE Industrial Capacity Zone, positioning UAE as China’s Gulf gateway), Technology & AI (cooperation agreements, digital transformation), Trade & Free Zones (JAFZA, DP World partnerships), and Finance & Investment (BRI projects in UAE totaling $3.1 billion, cross-border investment facilitation).

Recent developments (2024-2025) underscore this dynamism, with numerous MoUs, high-level visits, and a focus on new economy sectors, entrepreneurship, tourism, and aviation. Abu Dhabi serves as a primary investment hub, with Dubai facilitating trade, and free zones across emirates fostering partnerships. Additional key cooperation sectors include Healthcare & Pharmaceuticals (Mubadala’s acquisition of UCB Pharma’s China business, medical tech partnerships), Agriculture & Food Security (Silal and Shouguang Vegetable Group’s smart agricultural project), Aviation & Transportation (Emirates-Air China MoUs, eVTOL aircraft deal), Logistics & Supply Chain (JINGDONG Property’s Dubai hub, JD.com’s smart supply chain), Artificial Intelligence & Digital Transformation ($5 billion partnership, G42’s strategic role), Tourism & Hospitality (China-GCC tourism fair), and Financial Services & Fintech (China’s CIPS, UAE central bank cooperation, Abu Dhabi-China fintech partnerships).

In contrast, Hong Kong has historically served as China’s indispensable financial window to the world, a role it continues to uphold. As a superconnector, Hong Kong has facilitated a significant portion of mainland China’s foreign direct investment (FDI) and outward direct investment (ODI), originating and intermediating two-thirds of these flows [HKMA]. Its strengths lie in established banking, capital markets, and asset management sectors, providing a high-quality financial platform [Sovereign Group]. Hong Kong’s distinct financial, monetary, and legal systems [Investopedia] offer a unique environment for international investors. It remains a world-class financial center and the primary offshore Renminbi (RMB) hub, offering comprehensive financing channels for Belt and Road Initiative projects [EY]. The city’s robust IPO activity, exceeding $15 billion [San Diego Metro], solidifies its position as a vital conduit for Chinese enterprises. Despite competition, Hong Kong’s financial strength is largely attributed to opportunities from the Chinese mainland [SCIO], maintaining its rank among top global financial centers [Yicai Global, CDI].

Opportunities and Strategic Growth Drivers

Both the UAE and Hong Kong present compelling opportunities for attracting Chinese capital, leveraging distinct advantages. The United Arab Emirates benefits from its strategic location as a gateway to MENA, Africa, and Europe. Its aggressive diversification efforts into finance, technology, tourism, and logistics, coupled with a robust ecosystem of free zones and a business-friendly environment, enhance its appeal. A key driver is its strong alignment with China’s Belt and Road Initiative (BRI), with $3.1 billion in projects within the country. Specific growth areas like clean energy, AI, fintech, logistics, and tourism offer fertile ground for Chinese investment, exemplified by the Masdar-China Silk Road Fund MoU and the China-UAE Industrial Capacity Zone.

Hong Kong draws strength from its established financial infrastructure, including a mature legal and regulatory framework and a robust banking system. Its unparalleled role as a gateway to mainland China provides unique access to Chinese markets through mechanisms like Stock Connect programs. Hong Kong’s position as the primary offshore Renminbi (RMB) hub is instrumental in facilitating RMB internationalization. The city’s sophisticated wealth management sector and expertise in providing financing for Belt and Road Initiative projects further underscore its strategic importance. Hong Kong’s ability to facilitate significant IPO activity for Chinese companies seeking global capital markets is a testament to its enduring appeal.

Synergies between the UAE and Hong Kong are evident in opportunities for complementary market access, where Chinese companies might leverage the UAE for Middle Eastern and African market entry, and Hong Kong for broader international capital raising. Joint ventures, cross-listing opportunities, and shared expertise in BRI financing and project management could lead to collaborative efforts, fostering a more robust and interconnected financial network for Chinese investors.

Challenges and Critical Considerations

Both the UAE and Hong Kong face significant challenges in attracting Chinese capital. For the United Arab Emirates, these include an evolving regulatory landscape that requires continuous adaptation to meet international standards and investor expectations. The UAE also faces competition from other regional hubs and must navigate geopolitical dynamics in the broader Middle East, which can introduce perceived risks for some international investors.

Hong Kong confronts a unique set of challenges. Geopolitical tensions, particularly US-China relations, and the implementation of the National Security Law have raised concerns about its autonomy and rule of law, impacting investor confidence [Atlantis Press]. It faces increasing competition from mainland Chinese cities like Shanghai and Shenzhen, which are rapidly developing their financial capabilities [Yicai Global]. Concerns about talent outflow and an ongoing regulatory convergence with mainland China could dilute its historical advantages. Furthermore, Hong Kong’s economic growth is increasingly influenced by global trends and its close ties to the mainland economy [Hong Kai Impact Explained].

Strategic competition between the UAE and Hong Kong is also a critical consideration. Both hubs directly compete for Chinese capital flows, including IPOs, bond issuances, wealth management services, and BRI financing. The UAE’s focus on technology and its strategic geographic positioning offers an alternative for Chinese tech companies, while Hong Kong’s deep liquidity and sophisticated financial ecosystem continue to attract Chinese financial institutions. Understanding these competitive dynamics is crucial for both to refine their strategies and carve out distinct, yet potentially collaborative, niches.

Case Study Spotlight: COSCO Shipping Ports Abu Dhabi Terminal

A compelling illustration of Chinese capital flowing into the UAE, and its strategic implications, is the COSCO Shipping Ports Abu Dhabi Terminal at Khalifa Port. This joint venture between COSCO Shipping Ports Limited, a subsidiary of China COSCO Shipping Corporation Limited, and Abu Dhabi Ports, represents a significant investment in the UAE’s logistics and maritime infrastructure. Operational since 2018, the terminal is one of the largest container freight stations in the Middle East, boasting a design capacity of 2.5 million TEUs (twenty-foot equivalent units) and a quay length of 1,200 meters.

This project is a direct manifestation of China’s Belt and Road Initiative (BRI) in the UAE, positioning Khalifa Port as a crucial regional hub for COSCO’s global network. The investment not only enhances the UAE’s logistical capabilities, solidifying its role as a gateway for trade between East and West, but also facilitates increased trade volumes between China and the broader Middle East, Africa, and Europe. For Chinese companies, the terminal provides a strategic base for regional distribution and supply chain management, reducing transit times and costs. It also underscores the UAE’s commitment to providing world-class infrastructure that supports international trade and investment, directly attracting Chinese enterprises seeking to establish a strong regional presence. The success of the COSCO terminal exemplifies how Chinese capital, channeled into strategic infrastructure projects, can create mutual benefits, driving economic growth and strengthening bilateral ties.

Another significant example, illustrating Hong Kong’s enduring appeal to Chinese capital, is Alibaba Group’s secondary listing on the Hong Kong Stock Exchange (HKEX) in November 2019. While Alibaba initially pursued its IPO in the U.S., its subsequent listing in Hong Kong, raising approximately $13 billion, underscored the city’s critical role as a financial gateway for mainland Chinese technology giants. This move allowed Alibaba to tap into a broader investor base, particularly from mainland China, and provided a hedge against geopolitical risks associated with its U.S. listing.

Alibaba’s listing demonstrated Hong Kong’s capacity to attract mega-IPOs and its ability to adapt its listing rules to accommodate companies with weighted voting rights structures, a key factor for many tech firms. It reinforced Hong Kong’s position as a preferred venue for Chinese companies seeking dual listings or a ‘homecoming’ listing closer to their core operations and investor base. This case highlights Hong Kong’s sophisticated capital markets, its deep liquidity, and its unique connectivity to mainland Chinese capital, making it an indispensable platform for Chinese enterprises to access global funding and enhance their international profile.

Future Outlook and Strategic Recommendations

The future trajectory of Chinese capital flows is poised to continue its global expansion, driven by China’s ongoing economic development and its strategic initiatives like the Belt and Road Initiative. Both the UAE and Hong Kong are strategically positioned to capitalize on these trends, provided they adapt to evolving market dynamics and geopolitical shifts. The outlook suggests a continued emphasis on diversification, technological advancement, and deeper financial integration for both hubs.

For the United Arab Emirates, future growth in attracting Chinese capital will likely be propelled by its increasing role in new economy sectors and its robust infrastructure development. To further enhance its appeal, the UAE should:

- Deepen Financial Services Integration: Continue to develop sophisticated financial products and services tailored to Chinese investors, including RMB-denominated offerings and cross-border payment solutions, building on existing collaborations like CIPS and Abu Dhabi-China fintech partnerships.

- Leverage Digital Transformation and AI: Capitalize on its investments in AI and digital technologies, such as those involving G42 and Digital Dubai, to create an attractive ecosystem for Chinese tech companies and startups seeking to expand globally.

- Strengthen Sector-Specific Partnerships: Focus on targeted collaborations in high-growth sectors identified in the research, such as clean energy, smart agriculture, healthcare, and advanced manufacturing, by offering bespoke incentives and regulatory frameworks.

- Enhance Connectivity and Logistics: Further develop its world-class logistics and supply chain infrastructure, building on projects like JINGDONG Property’s hub and DP World partnerships, to serve as an even more efficient gateway for Chinese trade and investment into the MENA region and beyond.

Hong Kong, while facing its own set of challenges, remains an indispensable financial hub for Chinese capital. Its future success will hinge on its ability to reinforce its unique strengths and adapt to the changing global financial landscape. Key recommendations for Hong Kong include:

- Reaffirm Autonomy and Rule of Law: Proactively communicate and demonstrate the enduring strength of its independent legal system and regulatory framework to maintain international investor confidence, particularly in light of geopolitical concerns.

- Innovate Capital Market Offerings: Continue to innovate its capital market products, including facilitating more diverse listing options for Chinese companies (e.g., secondary listings, biotech IPOs) and expanding its role in green finance and sustainable investments.

- Strengthen RMB Internationalization: Solidify its position as the premier offshore RMB hub by expanding RMB liquidity, developing more RMB-denominated financial products, and facilitating cross-border RMB flows.

- Foster Greater Bay Area Integration: Deepen financial and economic integration within the Greater Bay Area, leveraging its proximity and unique status to create a synergistic financial ecosystem with mainland cities like Shenzhen and Guangzhou.

Strategic Recommendations for Synergistic Growth:

Instead of viewing each other solely as competitors, the UAE and Hong Kong can explore avenues for synergistic growth. This could involve:

- Joint Investment Platforms: Establishing co-investment funds or platforms targeting BRI projects, leveraging Hong Kong’s financial expertise and the UAE’s strategic project pipeline.

- Complementary Market Access: Facilitating Chinese companies to use Hong Kong for capital raising and then the UAE for regional operational headquarters and market entry into the Middle East and Africa.

- Knowledge Exchange: Sharing best practices in financial regulation, fintech innovation, and sustainable finance to collectively enhance their attractiveness to Chinese capital.

By focusing on their distinct strengths while exploring collaborative opportunities, both the UAE and Hong Kong can continue to play pivotal, albeit different, roles in attracting and channeling Chinese capital, contributing to a more diversified and resilient global financial system.

Conclusion

The narrative of global finance in the 21st century is increasingly shaped by the outward expansion of Chinese capital. In this evolving landscape, both the United Arab Emirates and Hong Kong have carved out indispensable, albeit distinct, roles as magnets for Chinese investment. The UAE, through its strategic geographical position, ambitious economic diversification, and proactive engagement with the Belt and Road Initiative, has rapidly ascended as a vital partner for China in the Middle East, Africa, and Europe. Its burgeoning sectors in clean energy, AI, and logistics offer new frontiers for collaboration. Hong Kong, conversely, leverages its deeply entrenched financial infrastructure, unique access to mainland markets, and pivotal role in RMB internationalization to remain a critical conduit for Chinese enterprises seeking global capital and international exposure. While both hubs face their own set of challenges, from regulatory complexities in the UAE to geopolitical pressures and internal competition in Hong Kong, their strategic importance to China’s global economic ambitions is undeniable. By recognizing their complementary strengths and actively seeking synergistic opportunities, such as joint investment platforms and shared expertise in BRI financing, the UAE and Hong Kong can not only mitigate competitive pressures but also forge a more robust and integrated financial ecosystem that effectively channels Chinese capital for mutual prosperity and global economic development.

References

[1] Atlantis Press. (2025). Hong Kong: Challenges and Prospects as an International…. Retrieved from https://www.atlantis-press.com/article/126007956.pdf

[2] World Economic Forum. (2025, March 25). Why IFCs like Hong Kong are crucial connectors in today’s…. Retrieved from https://www.weforum.org/stories/2025/03/international-finance-centres-hong-kong-crucial-connectors-fast-changing-world/

[3] Sovereign Group. (2024, November 27). The Benefits of Setting Up a Business Hub in Hong Kong. Retrieved from https://www.sovereigngroup.com/news/news-and-views/the-benefits-of-hong-kong-as-a-business-hub/

[4] SCIO. (2024, September 26). Hong Kong emerges stronger as leading global financial…. Retrieved from http://english.scio.gov.cn/chinavoices/2024-09/26/content_117450795.html

[5] Hong Kai Impact Explained. (2025, February 2). Retrieved from https://www4.acenet.edu/hong-kai-impact

[6] Atlantic Council. (2025, March 31). Dispatch from Hong Kong: How the ‘geoeconomic city’ is…. Retrieved from https://www.atlanticcouncil.org/blogs/new-atlanticist/dispatch-from-hong-kong-how-the-geoeconomic-city-is-weathering-global-headwinds/

[7] AMRO-Asia. (2023, January 11). As China Reopens to the World, Hong Kong Must Lean…. Retrieved from https://amro-asia.org/as-china-reopens-to-the-world-hong-kong-must-lean-into-super-connector-role/

[8] Hong Kong Monetary Authority. Dominant Gateway to China. Retrieved from https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/hong-kong-as-an-international-financial-centre/dominant-gateway-to-china/

[9] EY. (2025, September 15). Hong Kong’s role in the Belt and Road: from super-…. Retrieved from https://www.ey.com/en_cn/insights/china-overseas-investment-network/hong-kong-s-role-in-the-belt-and-road-from-super-connector-to-value-adding-partner

[10] San Diego Metro. (2025, September 19). Hong Kong: Global Financial Center or Beijing Sidekick?. Retrieved from https://www.sandiegometro.com/2025/09/hong-kong-global-financial-center-or-beijing-sidekick/

[11] Yicai Global. (2025, March 21). Shanghai, Shenzhen, Hong Kong Are Among World’s Top…. Retrieved from https://www.yicaiglobal.com/news/shanghai-shenzhen-hong-kong-are-among-worlds-top-10-global-financial-centers-report-shows

[12] Investopedia. (2024, December 2). Hong Kong vs. Mainland China: What’s the Difference?. Retrieved from https://www.investopedia.com/articles/investing/121814/hong-kong-vs-china-understand-differences.asp

[13] Reuters. (2025, July 23). Mainland China capital surge fuelling Hong Kong…. Retrieved from https://www.reuters.com/markets/europe/mainland-china-capital-surge-fuelling-hong-kong-investment-boom-2025-07-23/

[14] ResearchGate. A Study on the Reasons and Effects of the Second…. Retrieved from https://www.researchgate.net/publication/377180322_A_Study_on_the_Reasons_and_Effects_of_the_Second_Listing_of_Chinese_Concept_Stocks_Base_on_Alibaba

[15] Bloomberg. (2022, July 26). Why a Primary Listing in Hong Kong Matters for Alibaba…. Retrieved from https://www.bloomberg.com/news/articles/2022-07-26/why-a-primary-listing-in-hong-kong-matters-for-alibaba-bilibili

[16] Deloitte. (2025, September 24). Q3 2025 Review and Outlook for Chinese Mainland & HK…. Retrieved from https://www.deloitte.com/cn/en/about/press-room/mainland-and-hk-ipo-markets-in-q3-2025.html

[17] S&P Global Market Intelligence. (2025, July 14). Mainland China heavyweights lift Hong Kong to top IPO…. Retrieved from https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/7/mainland-china-heavyweights-lift-hong-kong-to-top-ipo-destination-90210496

[18] South China Morning Post. (2025, July 16). How Hong Kong stock exchange has simplified the IPO…. Retrieved from https://www.scmp.com/special-reports/article/3317382/how-hong-kong-stock-exchange-has-simplified-ipo-process

[19] Investopedia. (2025, September 19). Hong Kong SAR: A Leading Global Financial Hub in China. Retrieved from https://www.investopedia.com/terms/h/hong-kong-sar-china.asp

[20] Medium. Mainland China Pumps Over US$104 Billion into Hong…. Retrieved from https://medium.com/market-nexus/mainland-china-pumps-over-us-104-billion-into-hong-kong-in-2025-fueling-record-breaking-market-5e1d2f9b7a75

[21] OECD. Chinese Outward Investment in Hong Kong (EN). Retrieved from https://www.oecd.org/content/dam/oecd/en/publications/reports/1996/07/chinese-outward-investment-in-hong-kong_g17a15e5/000007223551.pdf

[22] Macquarie. (2025, August 26). Supporting a Hong Kong biotech IPO. Retrieved from https://www.macquarie.com/us/en/insights/supporting-a-hong-kong-biotech-ipo.html

[23] NerdWallet. (2025, September 8). 7 Best-Performing China Stocks for September 2025. Retrieved from https://www.nerdwallet.com/article/investing/chinese-stocks

[24] AAAHQ. (2016, November 1). Alibaba Group Initial Public Offering: A Case Study…. Retrieved from https://publications.aaahq.org/iae/article/31/4/449/8033/Alibaba-Group-Initial-Public-Offering-A-Case-Study

[25] Taylor & Francis Online. (2023). Impact of dual-class share structure: Alibaba IPO success…. Retrieved from https://www.tandfonline.com/doi/full/10.1080/13602381.2023.2179169 [26] OC&C Strategy Consultants. (2025, August 6). Unlocking Capital in Asia: The New Case for a Hong Kong…. Retrieved from https://www.occstrategy.com/en/article/unlocking-capital-in-asia-the-new-case-for-a-hong-kong-ipo/ [27] Law.com International. (2025, September 25). Hong Kong IPO Market Bounces Back With Billion Dollar…. Retrieved from https://www.law.com/international-edition/2025/09/24/hong-kong-ipo-market-bounces-back-with-billion-dollar-listings-by-zijin-gold-chery-auto/