The Dragon and the Falcon: A New Era for Oil

In the intricate tapestry of global energy, where geopolitical currents constantly shift and economic imperatives redefine alliances, a compelling narrative is unfolding between China, the world’s largest energy consumer, and the United Arab Emirates, a pivotal energy producer. This burgeoning partnership, often characterized by the symbolic imagery of the ‘Dragon’ and the ‘Falcon,’ is transcending traditional transactional exchanges to forge a robust, multifaceted energy cooperation. It is a relationship that moves decisively beyond the mere trade of hydrocarbons, embracing the vanguard of renewable energy and advanced technological collaboration, thereby signaling a new and profoundly strategic alignment in the 21st century. This article will delve into the historical underpinnings, the intricate industrial perspectives, and the forward-looking trajectory of China-UAE energy cooperation, illuminating how this dynamic alliance is not only reshaping their bilateral destinies but also influencing the broader contours of the global energy landscape.

I. Historical Foundations: From Transactional to Strategic Partnership

The genesis of the China-UAE energy relationship, like many nascent international partnerships, was rooted in pragmatic economic exchange. Initially, it was largely a transactional affair, driven by China’s burgeoning demand for oil to fuel its rapid industrialization and the UAE’s abundant hydrocarbon reserves. However, this foundational trade quickly evolved, propelled by mutual recognition of strategic interests and a shared vision for economic diversification and global influence.

A pivotal moment arrived in 2012, when the United Arab Emirates distinguished itself as the first Gulf country to establish a strategic partnership with China [1]. This landmark agreement elevated the bilateral relationship beyond simple buyer-seller dynamics, laying the groundwork for deeper collaboration across various sectors, including energy. The subsequent launch of China’s ambitious Belt and Road Initiative (BRI) in 2013 further catalyzed this evolution. The BRI, with its grand vision of enhancing global connectivity and fostering economic integration, found a high degree of alignment with the UAE’s aspirations for energy interconnection and market integration [1]. It was within this framework that China National Petroleum Corp (CNPC) and Abu Dhabi National Oil Co (ADNOC), two giants in their respective national energy landscapes, signed the Al Yasat project agreement, marking a significant step towards joint ventures in strategic energy assets in Abu Dhabi [1].

The partnership continued its upward trajectory. By 2017, the two nations inked another crucial cooperation deal for an onshore oil concession, with CNPC assuming the role of asset leader for the North-East Bab fields, a move that substantially enhanced their strategic collaboration [1]. The year 2018 witnessed another significant upgrade, as China-UAE bilateral relations were elevated to a comprehensive strategic partnership. This deepened commitment was swiftly followed by CNPC and ADNOC signing agreements to cooperate on the Umm Shaif & Nasr and Lower Zakum offshore fields. This expansion established a comprehensive cooperation framework in the UAE, encompassing both onshore and offshore operations and integrating the entire exploration and development industry chain [1]. These historical milestones underscore a deliberate and progressive journey from a purely transactional relationship to one characterized by profound strategic alignment and mutual investment in the future of energy.

II. Industrial Synergy: Deepening Cooperation in Hydrocarbons

The core of the China-UAE energy partnership, while diversifying, remains firmly anchored in the hydrocarbon sector, where industrial synergy between CNPC and ADNOC serves as a compelling model. This collaboration is not merely about supply and demand; it is a sophisticated interplay of technological expertise, operational efficiency, and strategic investment that benefits both nations.

A. CNPC and ADNOC: A Model Partnership

At the heart of this industrial cooperation lies the robust partnership between CNPC and ADNOC. Their collaboration spans the entire value chain of the oil and gas industry, from upstream exploration to downstream processing and trade.

- Upstream Exploration and Development: CNPC brings to the table its considerable technological advantages, particularly in the challenging domain of low-permeability carbonate reservoirs. This expertise has been instrumental in boosting production and reducing costs in the UAE’s North-East Bab fields, demonstrating a tangible transfer of advanced capabilities [1].

- Engineering Construction: Large-scale infrastructure projects are a testament to their collaborative spirit. Initiatives such as the BAB-Buhasa AiP5 off-plot project, the LNG Transmission Pipeline Project, and Project Swing are designed to substantially increase ADNOC’s capacity and operational efficiency. Crucially, these projects also promote local project execution capabilities within the UAE through the introduction of international engineering management models [1].

- Oilfield Services and Equipment: CNPC’s high-quality and efficient drilling services have played a significant role in reducing ADNOC’s development costs. Furthermore, the deployment of hybrid drilling rigs manufactured by CNPC exemplifies a commitment to sustainability, as these rigs reduce fuel consumption and emissions while improving drilling efficiency through intelligent remote monitoring and dispatching [1].

- Oil and Gas Trade: Beyond production, CNPC is an active participant in the trade of crude oil, natural gas, refined oil, and chemicals. Its unique position as the sole Chinese shareholder in the Abu Dhabi Futures Exchange further solidifies its integral role in the UAE’s energy market [1].

B. Broader Hydrocarbon Landscape

The CNPC-ADNOC partnership is emblematic of a broader trend of deepening hydrocarbon cooperation between China and the Gulf states. This extends to critical areas such as liquefied natural gas (LNG) and petrochemical integration.

- LNG Deals: The increasing demand for cleaner-burning natural gas in China has led to significant LNG contracts. For instance, in April 2025, ADNOC signed three term contracts with Chinese buyers for LNG, including a notable deal with China National Offshore Oil Corporation (CNOOC) for the annual purchase of 500,000 metric tons of LNG starting in 2026 [3]. This highlights China’s strategic diversification of its energy imports and the UAE’s growing role as a reliable LNG supplier.

- Petrochemical Integration: The collaboration is also extending into the petrochemical sector, indicating a move towards higher-value processing of hydrocarbons. While not exclusively UAE-China, the broader Gulf-China trend is illustrative. Saudi Aramco’s acquisition of a 10% stake in Rongsheng Petrochemical for $3.4 billion and its joint venture refinery project with Sinopec signal a growing level of petrochemical value chain integration across the region [3]. This trend suggests that China and the UAE are increasingly looking to move beyond crude oil exports to develop sophisticated downstream industries, creating more economic value and strengthening industrial ties. This comprehensive engagement in the hydrocarbon sector underscores the enduring importance of oil and gas in the China-UAE energy relationship, even as both nations strategically pivot towards a greener future.

III. The Green Horizon: Embracing Renewable Energy and Technology

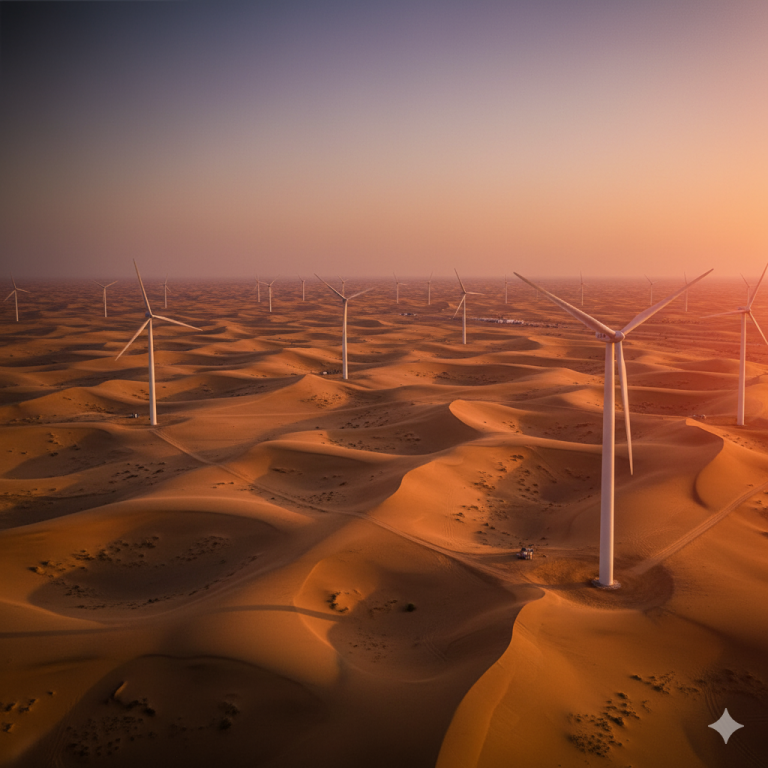

While the bedrock of China-UAE energy cooperation has historically been hydrocarbons, a significant and rapidly expanding frontier is the embrace of renewable energy and advanced technology. Both nations recognize the imperative of energy transition, driven by environmental concerns, economic diversification goals, and the global shift towards sustainable practices. China, with its unparalleled manufacturing capabilities and investment prowess in clean energy, has emerged as an indispensable partner in the Gulf states’ ambitious energy transition strategies [2].

A. China’s Dominance in Clean Energy Supply Chains

China’s role in the global clean energy landscape is undeniable. It has established itself as a dominant force across the entire supply chain, a position that directly benefits its partners, including the UAE.

- Solar and Wind Leadership: Chinese companies are not merely suppliers but active investors and co-investors in large-scale solar and wind projects across the UAE and the broader Middle East. This includes landmark initiatives where Chinese firms have taken leading roles in developing utility-scale renewable energy infrastructure [2].

- Manufacturing Prowess: The global dominance of Chinese manufacturers in clean energy components is a critical factor. The top six solar module manufacturers globally, by production value, are all Chinese companies. This extends to a wide array of other solar and wind components, where Chinese firms hold a commanding position along the value chains. This ensures that Gulf states, including the UAE, have access to the cheapest and most efficient components for their renewable energy projects, even if it means importing rather than developing local manufacturing capabilities in the short term [2].

B. Investment and Development

China’s engagement in the UAE’s green energy sector is characterized by substantial investment and active participation in project development.

- Jinko Solar’s Pivotal Role: Jinko Solar, one of the world’s largest module manufacturers, exemplifies this trend. It has not only supplied modules but has also led consortiums that have won significant solar tenders in Saudi Arabia. In the UAE, Jinko played a similar crucial role in the 1.2 gigawatt-peak (GWp) Al Sweihan project in Abu Dhabi, one of the largest single-site photovoltaic (PV) projects globally. In such projects, Chinese firms often capture a substantial portion of the value chain, acting as both developer and module supplier [2].

- Silk Road Fund and ACWA Power: A clear signal of deepening cooperation came in 2019 with the announcement that China’s state-owned Silk Road Fund had acquired a 49 percent stake in ACWA Power Renewable Energy Holding (ACWA Power RenewCo). ACWA Power is a major Saudi renewable energy project holding company with significant assets, including those in the UAE. This transaction followed earlier greenfield co-development deals between ACWA and the Silk Road Fund, relating to solar projects in the UAE. As of October 2023, total Chinese investment in ACWA projects had exceeded $10 billion, underscoring the scale of this financial commitment [2].

- Chinese Contractors: Chinese contractors, such as the China Energy Engineering Group and Shanghai Electric, have also been instrumental in building the initial wave of utility-scale renewable energy projects in the region [2].

C. Technological Collaboration

Beyond hardware and investment, technological collaboration forms another pillar of the green horizon, with Chinese expertise contributing to the UAE’s digital and smart infrastructure ambitions.

- Digital Infrastructure: Chinese heavyweights like Huawei have been pivotal in building out the digital infrastructure that underpins the UAE’s future smart cities and industries. Huawei’s involvement in the UAE’s push for a 5G network has not only advanced the region’s technological development but also fostered a closer partnership in digital innovation [3].

- Smart Infrastructure and Renewable Energy Expertise: The UAE’s ambitious national strategies, such as Vision 2030, aim to reduce oil dependence and attract foreign investment. These top-down reforms have created fertile ground for global players, including Chinese firms, to contribute not just capital but also invaluable expertise in digitalization, smart infrastructure, and renewable energy. Chinese battery and solar manufacturers, including LONGi, JA Solar, JinkoSolar, and Trina, are actively present across the UAE and other Gulf states, contributing to the region’s green transformation [3]. This comprehensive approach to renewable energy and technology collaboration highlights a shared commitment to innovation and sustainability, positioning the China-UAE partnership at the forefront of the global energy transition.

IV. Beyond Energy: Economic Diversification and Geopolitical Realignment

The deepening energy cooperation between China and the UAE is not an isolated phenomenon but rather a significant component of a broader, evolving relationship characterized by robust economic diversification and a notable geopolitical realignment. Both nations are strategically navigating a multipolar world, seeking to enhance their resilience and influence through diversified partnerships.

A. Trade and Financial Integration

The economic ties between China and the UAE have expanded dramatically, moving beyond energy trade to encompass a wide array of sectors, fostering significant financial integration.

- Growing Trade Volume: China has solidified its position as the UAE’s largest trading partner. In 2024, the non-oil trade between the UAE and China reached an impressive $90.1 billion, underscoring the breadth and depth of their commercial relationship beyond hydrocarbons [3]. This robust trade volume reflects a deliberate strategy by the UAE to diversify its economy away from oil dependence.

- RMB Settlements and Currency Swaps: A clear indicator of increasing financial integration is the tripling of RMB settlements over the last five years. Furthermore, the Gulf Cooperation Council (GCC), of which the UAE is a key member, has signed currency-swap and naming arrangements with China. These measures are designed to enhance trade resilience and reduce reliance on traditional reserve currencies, reflecting a broader trend towards de-dollarization in international trade [3].

- Sovereign Wealth Fund Investments: Gulf sovereign wealth funds (SWFs), such as Abu Dhabi’s ADQ, are actively increasing their investments in China, particularly in high-growth sectors like technology and green energy. This strategic allocation of capital reflects a belief in China’s long-term growth prospects and a desire to diversify portfolios away from Western-dominated markets [3].

B. Strategic Motivations

The motivations underpinning this enhanced partnership are deeply strategic for both Beijing and Abu Dhabi, reflecting their respective national interests and global ambitions.

- China’s Perspective: For China, the partnership with the UAE is multifaceted. It ensures crucial energy security, vital for its continued economic growth. It also serves to deepen the success of the Belt and Road Initiative, extending its reach and influence across key global trade routes. Furthermore, it allows China to forge new diplomatic influence in a strategically important region, while simultaneously reducing its exposure to Western-led institutions and geopolitical pressures [3].

- UAE’s Perspective: The UAE’s engagement with China is a deliberate component of its eastward pivot. This strategy aims to diversify its alliances and reduce its historical integration with, and dependence on, Western powers. China’s policy of non-interference in internal affairs and its long-term investment strategies make it an attractive and reliable partner, especially when contrasted with Western powers that often attach political conditions to investments. The UAE’s decision to join BRICS+ in 2024 is a clear and unequivocal signal of this strategic realignment, positioning itself within a bloc that represents a significant portion of the global economy and population [3].

C. Cultural and Talent Exchange

Beyond economic and geopolitical considerations, the partnership is also fostering deeper cultural understanding and talent development, building bridges between the two civilizations.

- Educational Cooperation: Initiatives such as the Hundred Schools Project, which promotes Chinese language education in the UAE, are continuously fostering cultural exchange and mutual understanding. This educational cooperation extends to scholarship programs, startup exchanges, and visa facilitation, all of which are gaining traction as foundational enablers for long-term partnerships [1, 3].

- Emiratization Policy: Chinese companies operating in the UAE, such as CNPC, actively support the UAE’s Emiratization policy by promoting the recruitment and cultivation of local talent. This commitment to local workforce development strengthens the social fabric of the partnership and ensures mutual benefit [1].

This comprehensive engagement, extending far beyond the traditional energy sector, positions the China-UAE relationship as a dynamic force in shaping a new global order, characterized by diversified economic ties and a rebalanced geopolitical landscape.

The Dragon and the Falcon: A New Era for Oil” has been a journey of strategic evolution, industrial synergy, and a shared vision for a sustainable future. From its transactional beginnings to its current comprehensive strategic partnership, the China-UAE energy relationship has matured into a dynamic force that is not only reshaping their bilateral destinies but also influencing the broader contours of the global energy landscape. The historical foundations, built on mutual economic needs and solidified by initiatives like the BRI, have paved the way for deep industrial cooperation in hydrocarbons, exemplified by the CNPC-ADNOC partnership. This collaboration, however, is not static; it is actively embracing the green horizon, with significant Chinese investment and technological prowess driving the UAE’s renewable energy ambitions. Beyond the energy sector, the partnership is fostering broader economic diversification, financial integration, and a notable geopolitical realignment, marked by the UAE’s eastward pivot and its engagement with blocs like BRICS+. While challenges such as regulatory complexities and geopolitical risks persist, the shared commitment to innovation, sustainability, and mutual resilience ensures a positive trajectory. The China-UAE energy partnership stands as a testament to the power of strategic collaboration in a rapidly changing world, demonstrating how two nations, with distinct strengths and shared aspirations, can forge a new era of cooperation that benefits both their peoples and the global community. The future, undoubtedly, holds even deeper and more meaningful collaborations as the Dragon and the Falcon continue their flight together towards a prosperous and sustainable tomorrow.

References

[1] CNPC’s high-quality development in the UAE. (2025, September 1). China Daily. https://www.chinadaily.com.cn/a/202509/01/WS68b51611a3108622abc9e331.html

[2] China’s Essential Role in the Gulf States’ Energy Transitions. (2023, December 11). CSIS. https://www.csis.org/analysis/chinas-essential-role-gulf-states-energy-transitions

[3] China–Middle East Relations in Transition. (2025, July 31). CKGSB Knowledge. https://english.ckgsb.edu.cn/knowledge/article/china-middle-east-relations-in-transtion/

utual understanding. This educational cooperation extends to scholarship programs, startup exchanges, and visa facilitation, all of which are gaining traction as foundational enablers for long-term partnerships [1, 3].

- Emiratization Policy: Chinese companies operating in the UAE, such as CNPC, actively support the UAE’s Emiratization policy by promoting the recruitment and cultivation of local talent. This commitment to local workforce development strengthens the social fabric of the partnership and ensures mutual benefit [1].

This comprehensive engagement, extending far beyond the traditional energy sector, positions the China-UAE relationship as a dynamic force in shaping a new global order, characterized by diversified economic ties and a rebalanced geopolitical landscape.

V. Challenges and Future Outlook

Despite the overwhelmingly positive trajectory and the multitude of mutual benefits, the China-UAE partnership is not without its challenges. Navigating these complexities will be crucial for sustaining the long-term success of their collaboration. However, the future outlook remains bright, with both nations poised to deepen their strategic alignment and unlock new avenues of cooperation.

A. Navigating Complexities

- Regulatory and Cultural Barriers: For Chinese investors and companies operating in the Middle East, navigating the diverse regulatory and legal landscapes can be a significant hurdle. Each country in the region, despite its similarities, has its own unique set of rules and procedures. Success often requires strong local partnerships and a deep understanding of political and, at times, religious dynamics. Cultural differences, though diminishing with increased exchange, can also present challenges for Chinese businesses in the Middle East [3].

- Geopolitical Risks: The Middle East remains a region of significant geopolitical volatility. China’s heavy reliance on energy flows through the Strait of Hormuz, a critical chokepoint, leaves it vulnerable to regional conflicts and escalations. The ongoing tensions between the United States and China also cast a shadow, as the UAE and other Gulf states must perform a delicate balancing act, pursuing economic and technological cooperation with China while maintaining long-standing defense and security ties with the US. This strategic hedging, while pragmatic, requires careful management to avoid being caught in the crossfire of great power competition [3].

B. Positive Trajectory and Mutual Benefits

Despite these challenges, the future of China-UAE energy cooperation is exceptionally promising. The partnership is poised for continued growth, driven by a shared vision for a sustainable and prosperous future.

- Continued Growth and Deeper Collaboration: The current trend suggests that the collaboration between China and the UAE will only deepen. The initial financial and project-based partnerships are expected to evolve into more integrated, ecosystem-level collaborations, blending research and development, local knowledge, and shared governance. The expectation is a shift towards more meaningful and strategic alignment as both nations adjust their expectations and deepen their mutual trust [3].

- Shared Vision for a Green Future: Both China and the UAE are committed to building a greener, more inclusive, and sustainable multidimensional energy cooperation framework. This shared vision extends beyond simply deploying renewable energy projects to encompass joint research, technological innovation, and the development of green finance mechanisms. PetroChina’s decision to join the Oil and Gas Decarbonization Charter at COP28, hosted by the UAE in 2024, is a testament to this shared commitment to a sustainable energy future [1].

- Enhanced Resilience and Energy Security: For both nations, the diversification of their energy sources and partnerships enhances their resilience. For China, a stable and reliable supply of energy from the UAE is crucial for its economic security. For the UAE, a diversified customer base and a strong partnership with the world’s largest energy consumer provide a hedge against market volatility and geopolitical shifts. This mutual reinforcement of energy security is a powerful driver of their continued collaboration.

VI. Conclusion

The narrative of “The Dragon and the Falcon: A New Era for Oil” has been a journey of strategic evolution, industrial synergy, and a shared vision for a sustainable future. From its transactional beginnings to its current comprehensive strategic partnership, the China-UAE energy relationship has matured into a dynamic force that is not only reshaping their bilateral destinies but also influencing the broader contours of the global energy landscape. The historical foundations, built on mutual economic needs and solidified by initiatives like the BRI, have paved the way for deep industrial cooperation in hydrocarbons, exemplified by the CNPC-ADNOC partnership. This collaboration, however, is not static; it is actively embracing the green horizon, with significant Chinese investment and technological prowess driving the UAE’s renewable energy ambitions. Beyond the energy sector, the partnership is fostering broader economic diversification, financial integration, and a notable geopolitical realignment, marked by the UAE’s eastward pivot and its engagement with blocs like BRICS+. While challenges such as regulatory complexities and geopolitical risks persist, the shared commitment to innovation, sustainability, and mutual resilience ensures a positive trajectory. The China-UAE energy partnership stands as a testament to the power of strategic collaboration in a rapidly changing world, demonstrating how two nations, with distinct strengths and shared aspirations, can forge a new era of cooperation that benefits both their peoples and the global community. The future, undoubtedly, holds even deeper and more meaningful collaborations as the Dragon and the Falcon continue their flight together towards a prosperous and sustainable tomorrow.

References

[1] CNPC’s high-quality development in the UAE. (2025, September 1). China Daily. https://www.chinadaily.com.cn/a/202509/01/WS68b51611a3108622abc9e331.html

[2] China’s Essential Role in the Gulf States’ Energy Transitions. (2023, December 11). CSIS. https://www.csis.org/analysis/chinas-essential-role-gulf-states-energy-transitions

[3] China–Middle East Relations in Transition. (2025, July 31). CKGSB Knowledge. https://english.ckgsb.edu.cn/knowledge/article/china-middle-east-relations-in-transtion/