The Digital Dragon and the Fintech Oasis: Unpacking UAE-China Cooperation in Cross-Border Payments and Financial Technology

Executive Summary

The United Arab Emirates (UAE) and China have forged a robust and rapidly expanding strategic partnership, with bilateral trade reaching an unprecedented $101.8 billion in 2024. This burgeoning relationship extends significantly into the realm of financial technology (fintech) and cross-border payments, areas critical for enhancing economic integration and facilitating global trade. The UAE, positioning itself as a ‘Fintech Oasis’ through proactive regulatory frameworks and digital infrastructure investments, is increasingly aligning with China’s ‘Digital Dragon’ – a global leader in digital innovation and payment solutions. This article critically examines the multifaceted cooperation between these two nations, highlighting the strategic opportunities driven by initiatives like the Belt and Road Initiative (BRI) and the mutual pursuit of digital economic transformation. While acknowledging the immense potential, it also addresses the inherent challenges, including regulatory harmonization and technological integration, offering strategic recommendations for a more resilient and efficient financial future. This collaboration is poised to redefine international payment landscapes and foster deeper economic ties.

Introduction

The economic and strategic ties between the United Arab Emirates and the People’s Republic of China have witnessed a remarkable transformation over the past decades, evolving from nascent trade relations to a comprehensive strategic partnership. With bilateral trade experiencing an astonishing 800-fold growth since 1984, culminating in a record $101.8 billion in 2024, the UAE has solidified its position as China’s largest export market in the Middle East and its second-largest trading partner in the region. At the heart of this dynamic relationship lies a shared vision for digital economic advancement, particularly evident in the burgeoning collaboration in financial technology and cross-border payments. China, often referred to as the ‘Digital Dragon,’ has pioneered advancements in digital payments, e-commerce, and blockchain technology, setting global benchmarks for innovation. Concurrently, the UAE is rapidly emerging as a ‘Fintech Oasis,’ actively cultivating an environment conducive to financial innovation through strategic investments, supportive regulations, and a diverse talent pool. This article aims to unpack the intricate layers of UAE-China cooperation in cross-border payments and financial technology, exploring the drivers, opportunities, challenges, and future trajectory of this pivotal partnership. By analyzing key initiatives and recent developments, we seek to provide a comprehensive understanding of how this collaboration is shaping the global financial landscape and fostering a new era of digital economic synergy between East and West.

The Current Landscape of Bilateral Cooperation

The relationship between the UAE and China has evolved into a comprehensive strategic partnership, characterized by robust economic ties and frequent high-level diplomatic engagements. This partnership is underpinned by significant trade volumes and mutual investments, making the UAE a pivotal economic partner for China in the Middle East. Bilateral trade reached an impressive $101.8 billion in 2024, marking an extraordinary 800-fold increase since 1984. This growth underscores the deepening economic interdependence, with the UAE serving as China’s largest export market in the Middle East and its second-largest trading partner in the region. Conversely, China consistently remains the UAE’s largest trading partner, reflecting a balanced and mutually beneficial commercial exchange. The presence of over 15,000 Chinese firms operating in the UAE further illustrates the scale of this economic integration, contributing significantly to local employment and economic diversification.

Investment flows are equally robust, with UAE investments in China reaching $4.5 billion by the end of 2023, representing a substantial 96% increase from the previous year. This upward trend signifies growing confidence and strategic alignment between the two nations. The establishment of a Comprehensive Strategic Partnership in 2018 provided a formal framework for this collaboration, leading to the formation of the UAE-China Investment and Economic Cooperation Working Group. This group facilitates regular dialogues and strategic agreements, ensuring sustained momentum in various sectors.

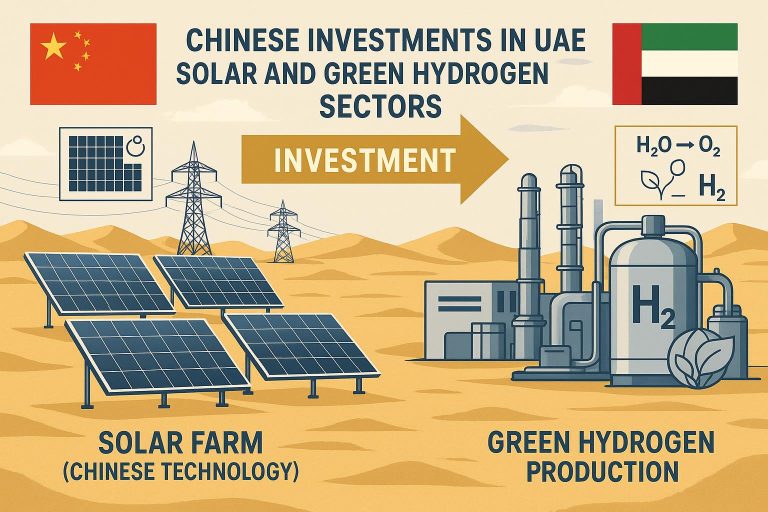

Beyond trade and direct investment, cooperation spans a multitude of sectors. Energy, including clean energy initiatives like solar and wind power, sees significant joint ventures, such as the Masdar-China Silk Road Fund MoU for renewable energy projects. Infrastructure and Logistics are critical pillars, exemplified by the COSCO terminal at Khalifa Port and the China-UAE Industrial Capacity Zone, which strategically positions the UAE as China’s gateway to the Gulf. Technology and AI cooperation agreements are driving digital transformation initiatives, while Trade and Free Zones like JAFZA and DP World foster robust partnerships with Chinese counterparts. Within this broad spectrum, Finance and Investment play a crucial role, particularly through Belt and Road Initiative (BRI) projects, which have seen $3.1 billion invested in the UAE, facilitating cross-border investment and financial connectivity. These foundational elements create a fertile ground for specialized cooperation in fintech and cross-border payments, which are increasingly becoming central to the bilateral economic agenda.

Opportunities and Strategic Growth Drivers

The deepening strategic partnership between the UAE and China presents a fertile ground for significant growth in cross-border payments and financial technology. This synergy is driven by several key factors, including the ambitious Belt and Road Initiative (BRI), the mutual pursuit of digital economic transformation, and the UAE’s strategic positioning as a regional financial hub. The integration of financial services and fintech is not merely an ancillary aspect but a critical enabler for the broader economic cooperation, facilitating trade, investment, and cultural exchange.

One of the primary strategic growth drivers is the Belt and Road Initiative (BRI). With over $3.1 billion in BRI projects already invested in the UAE, there is an inherent need for efficient and secure cross-border payment mechanisms to support these massive undertakings. China’s advanced digital payment infrastructure, coupled with the UAE’s rapidly evolving fintech ecosystem, offers a unique opportunity to streamline financial transactions associated with BRI projects. This collaboration can reduce transaction costs, enhance transparency, and accelerate the flow of capital, thereby boosting the overall efficiency and attractiveness of BRI investments in the region.

The commitment of both nations to digital transformation further fuels this cooperation. China, as the ‘Digital Dragon,’ has revolutionized its domestic payment landscape with platforms like Alipay and WeChat Pay, and is actively promoting the internationalization of its financial infrastructure. The UAE, in turn, is aggressively pursuing its vision to become a ‘Fintech Oasis,’ attracting global fintech talent and investment through supportive regulatory sandboxes and initiatives like Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC). This shared digital ambition creates a natural alignment for collaboration in areas such as central bank digital currencies (CBDCs), blockchain-based payment solutions, and regulatory technology (RegTech).

Specific initiatives underscore the tangible progress in this domain. The cooperation between China’s Cross-Border Interbank Payment System (CIPS) and the UAE Central Bank is a landmark development, aiming to enhance direct payment connectivity and reduce reliance on traditional correspondent banking networks. This direct linkage promises faster, more cost-effective, and more resilient payment channels between the two economies. Furthermore, Abu Dhabi-China fintech partnerships and investment promotion efforts are actively fostering innovation, attracting Chinese fintech companies to establish their regional presence in the UAE, and vice versa. The launch of UAE-China financial industry cooperation through ETF launches signifies a growing sophistication in capital market integration, providing investors with new avenues for cross-border portfolio diversification and liquidity.

The UAE’s role as a critical logistics and trade hub for China-Middle East trade further amplifies the need for advanced cross-border payment solutions. With entities like JINGDONG Property establishing its first Middle East logistics hub in Dubai and JD.com implementing smart supply chain technologies, the volume and complexity of financial transactions are set to increase. Efficient fintech solutions are essential to support these burgeoning trade corridors, ensuring seamless financial flows for goods and services. This strategic convergence of digital innovation, infrastructure development, and financial integration positions UAE-China cooperation in cross-border payments and fintech as a powerful engine for future economic growth and global financial connectivity.

Challenges and Critical Considerations

Despite the significant opportunities and strategic alignment, the UAE-China cooperation in cross-border payments and financial technology is not without its challenges. Navigating these complexities is crucial for ensuring the long-term sustainability and effectiveness of their collaborative efforts. Key considerations revolve around regulatory harmonization, technological interoperability, data governance, and geopolitical dynamics.

One of the foremost challenges lies in regulatory harmonization. Both the UAE and China possess distinct regulatory frameworks governing financial services and fintech. While the UAE has established progressive regulatory sandboxes and free zones like ADGM and DIFC to foster innovation, China operates under a more centralized and often stringent regulatory environment. Bridging these differences to create a seamless and compliant cross-border payment ecosystem requires continuous dialogue, mutual understanding, and potentially the development of common standards or recognition agreements. Discrepancies in anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations, as well as consumer protection laws, could pose significant hurdles for fintech companies operating across both jurisdictions.

Technological interoperability and integration present another critical consideration. While both nations are technologically advanced, their digital infrastructures and payment systems may not always be inherently compatible. Integrating diverse payment rails, blockchain platforms, and data exchange protocols requires substantial technical effort and standardization. Ensuring that systems can communicate efficiently and securely, without compromising data integrity or transaction speed, is paramount. This includes addressing issues related to API standardization, cloud infrastructure compatibility, and cybersecurity protocols.

Data governance and privacy concerns are also increasingly important. China has robust data localization and cybersecurity laws, while the UAE is also strengthening its data protection regulations. The cross-border flow of financial data, especially sensitive personal and transactional information, necessitates clear agreements on data storage, processing, and protection. Building trust and ensuring compliance with varying data privacy regimes will be essential to facilitate secure and reliable cross-border financial services.

Finally, the broader geopolitical landscape can influence the trajectory of this cooperation. While the partnership is strategically beneficial for both nations, global geopolitical shifts and the evolving dynamics of international finance could introduce external pressures or complexities. Maintaining a balanced approach that serves the interests of both the UAE and China, while navigating global financial norms and expectations, will be a continuous challenge. Addressing these critical considerations proactively through policy coordination, technological investment, and robust governance frameworks will be vital for unlocking the full potential of the UAE-China fintech partnership.

Case Study Spotlight: CIPS and UAE Central Bank Cross-Border Payment Cooperation

A compelling illustration of the deepening financial integration between the UAE and China is the ongoing cooperation between China’s Cross-Border Interbank Payment System (CIPS) and the UAE Central Bank. This strategic collaboration represents a significant step towards enhancing direct payment connectivity and reducing reliance on traditional international payment networks. CIPS, launched by the People’s Bank of China, is designed to provide clearing and settlement services for cross-border RMB transactions, thereby facilitating the international use of the Chinese yuan.

The partnership with the UAE Central Bank aims to integrate the UAE’s financial infrastructure more closely with China’s, enabling more efficient and direct settlement of trade and investment flows between the two nations. This initiative is particularly impactful for businesses engaged in bilateral trade, as it promises to streamline payment processes, reduce transaction costs, and mitigate foreign exchange risks. By establishing direct channels, the cooperation fosters greater financial stability and predictability for enterprises operating in both markets.

This case study exemplifies the proactive approach taken by both the UAE and China to build a resilient and independent financial architecture that supports their growing economic partnership. It not only facilitates the increasing volume of bilateral trade, which reached $101.8 billion in 2024, but also strengthens the UAE’s position as a key financial gateway for China’s economic engagement with the wider Middle East and Africa region. Such direct payment connectivity programs are vital for fostering deeper economic ties and promoting the broader adoption of digital financial solutions in cross-border transactions.

Future Outlook and Strategic Recommendations

The future of UAE-China cooperation in cross-border payments and financial technology is poised for continued growth and innovation, driven by shared economic ambitions and a commitment to digital transformation. The trajectory suggests a deepening integration of financial systems, with both nations leveraging their respective strengths to build a more efficient, secure, and inclusive global financial architecture. To fully realize this potential, several strategic recommendations can guide future collaborative efforts.

Firstly, enhanced regulatory dialogue and harmonization are paramount. Establishing a joint regulatory working group focused specifically on fintech and cross-border payments could facilitate the exchange of best practices, address regulatory arbitrage concerns, and work towards common standards for digital assets, data privacy, and cybersecurity. This would provide greater clarity and certainty for fintech innovators and financial institutions operating across both jurisdictions.

Secondly, investing in shared technological infrastructure is crucial. This includes exploring joint ventures in blockchain-based payment solutions, central bank digital currency (CBDC) initiatives, and artificial intelligence applications for fraud detection and risk management. Collaborative research and development hubs could accelerate the creation of interoperable platforms that seamlessly connect the UAE and Chinese financial ecosystems, reducing friction and increasing transaction speeds.

Thirdly, fostering talent exchange and capacity building will be vital. Programs that encourage fintech professionals, researchers, and entrepreneurs to work and study in both countries can lead to a cross-pollination of ideas and expertise. This would not only enhance the innovation capabilities of both nations but also build a deeper understanding of each other’s market dynamics and regulatory landscapes.

Fourthly, expanding the scope of financial products and services tailored for bilateral trade and investment is recommended. This could include the development of specialized trade finance platforms, cross-border wealth management solutions, and innovative insurance products that cater to the unique needs of businesses and individuals engaged in UAE-China economic activities. The launch of more cross-listed ETFs and other investment vehicles can further deepen capital market integration.

Finally, promoting the use of local currencies in bilateral transactions, supported by robust cross-border payment systems like CIPS, should be a strategic priority. This would reduce reliance on third-party currencies, mitigate exchange rate risks, and enhance the financial sovereignty of both nations. By proactively addressing these areas, the UAE and China can solidify their position at the forefront of global financial innovation, creating a model for future international economic partnerships.

Conclusion

The strategic partnership between the UAE and China has evolved into a dynamic force, particularly in the critical domains of cross-border payments and financial technology. The convergence of China’s digital prowess and the UAE’s ambition to become a leading fintech hub has created a powerful synergy, driving innovation and fostering deeper economic integration. From record-breaking bilateral trade figures to strategic collaborations in digital payment systems, the two nations are actively shaping a new paradigm for global financial connectivity. While challenges related to regulatory harmonization, technological interoperability, and data governance persist, the proactive engagement and shared vision of both governments and private sectors indicate a strong commitment to overcoming these hurdles. By continuing to invest in shared infrastructure, fostering talent exchange, and expanding financial product offerings, the UAE and China are not only strengthening their bilateral ties but also setting a precedent for how emerging economies can collaboratively build a more resilient, efficient, and inclusive global financial ecosystem. This partnership, characterized by mutual respect and strategic foresight, is poised to unlock unprecedented opportunities in the digital economy, benefiting both nations and contributing to a more interconnected world.

References

[1] UAE-China Bilateral Investment Research Findings (Provided in task input)